SushiSwap represents a dynamic innovation in the decentralized finance (DeFi) landscape. Originating as a fork of Uniswap, it has expanded its functionalities to offer a more community-oriented and feature-rich ecosystem. At its core, SushiSwap facilitates automated transactions between cryptocurrency tokens on the Ethereum blockchain using smart contracts.

Project History

SushiSwap was launched in September 2020 during the DeFi boom. It quickly distinguished itself from Uniswap by introducing the SUSHI token, which not only offered transaction fee sharing but also governance capabilities to its holders. The project’s anonymous founder, known as Chef Nomi, initially drew criticism and controversy after withdrawing a significant amount of funds from the project’s development fund. However, after returning these funds and transferring control to Sam Bankman-Fried, CEO of FTX, and then to the community, SushiSwap regained trust and has continued to develop under community governance.

What is SushiSwap?

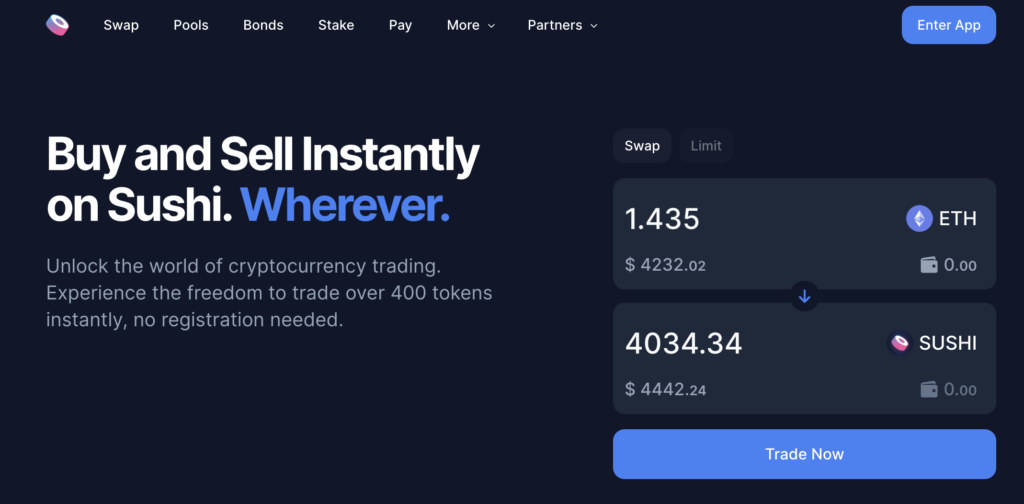

SushiSwap is a decentralized exchange (DEX) that allows users to swap various cryptocurrencies without needing an intermediary, providing liquidity directly through user-created liquidity pools. This setup aims to solve issues related to high fees and slow processing times seen in traditional exchanges, by utilizing automated solutions governed by algorithms instead of manual market-making.

How SushiSwap Works

SushiSwap is built on a combination of advanced blockchain technologies, each serving a critical role in its operation. Its infrastructure relies heavily on Ethereum, leveraging the security and extensive development of the Ethereum network. However, SushiSwap differentiates itself by not being limited to Ethereum; it operates across multiple blockchains, such as Polygon, BNB Smart Chain, and others, to enhance scalability and reduce transaction costs.

Blockchain and Consensus Mechanism

Initially, SushiSwap utilizes the Ethereum blockchain which adopts the Proof of Work (PoW) consensus mechanism, though Ethereum’s recent transition to Proof of Stake (PoS) marks a significant shift. The integration with Ethereum means that SushiSwap benefits from the high security and interoperability Ethereum offers. For blockchains like BNB Smart Chain, SushiSwap uses a consensus model called Delegated Proof of Stake (DPoS), where selected validators produce blocks and verify transactions.

Smart Contracts and Automated Market Making

The core technology enabling SushiSwap’s functionality is its smart contracts. These are self-executing contracts with the terms of the agreement directly written into code. In SushiSwap’s case, these contracts handle the creation and management of liquidity pools, execute trades without an order book, and distribute rewards. Unlike traditional exchanges, which use order books to pair buy and sell orders, SushiSwap uses an Automated Market Maker (AMM) model. This model allows assets to be traded automatically by using liquidity pools rather than relying on traditional market makers. Each trade incurs a small fee, part of which is redistributed to liquidity providers in the form of SUSHI tokens, thereby incentivizing liquidity.

Unique Algorithm: SushiSwap’s AMM

What sets SushiSwap’s AMM apart is its use of a constant product formula, ( x * y = k ), where ( x ) and ( y ) represent the quantity of two tokens in a liquidity pool, and ( k ) is a constant. This formula ensures that the pool remains balanced, regardless of the size of a trade. Additionally, SushiSwap introduced an on-chain governance mechanism, where SUSHI token holders can propose and vote on changes to the protocol. This includes adjustments to fee structures or even strategic decisions about the protocol’s future.

Cross-Chain Functionality

SushiSwap’s cross-chain functionality is a critical aspect of its technological architecture. By supporting multiple blockchains, SushiSwap allows users to experience lower fees and faster transactions on networks other than Ethereum. This is achieved through bridges and wrapped tokens that facilitate the movement of assets between different blockchains, enhancing the platform’s accessibility and usability.

Tokenomics of SushiSwap

The SUSHI token is an integral component of the SushiSwap ecosystem, serving as a utility and governance token rather than a coin. Unlike coins, which are typically native to their own blockchain and used primarily as a medium of exchange, SUSHI is issued on the Ethereum blockchain and facilitates various functionalities within the SushiSwap platform.

Nature and Role of SUSHI Token

SUSHI allows token holders to participate in community governance, meaning they can propose and vote on changes to the protocol. This engagement model not only decentralizes decision-making but also aligns the interests of the users with the development of the platform. Additionally, SUSHI tokens are used to incentivize liquidity providers. When users provide liquidity to SushiSwap’s pools, they earn SUSHI tokens as a reward, which can be staked further to earn additional yield, known as “SushiBar”.

Emission Model

SUSHI’s emission model was initially set to reduce the supply over time, aiming to create scarcity and potentially increase the token’s value. The token distribution began with an aggressive mining phase, known as “liquidity mining,” where 1,000 SUSHI tokens were distributed per block to liquidity providers. This rate was later reduced, and currently, about 100 SUSHI are distributed per block, following a community vote to extend the emission schedule and decrease the rate gradually.

Price Dynamics and Market Factors

The price of SUSHI is influenced by several factors including the overall demand for SushiSwap’s services, the DeFi market trends, and the broader crypto-economic environment. Being a governance token, its value is also closely tied to the perceived efficiency and potential of the platform to innovate within the DeFi space. The token has experienced significant volatility, reflective of the broader cryptocurrency market trends and internal developments within the SushiSwap community.

Rewards and Staking Mechanism

Staking SUSHI in SushiSwap’s SushiBar (xSUSHI) is another critical aspect of its tokenomics. When SUSHI is staked in the SushiBar, users receive xSUSHI, which represents a share of the SushiBar and accrues a portion of the transaction fees generated by the platform. This mechanism not only incentivizes holding the token longer, reducing market circulation, but also offers holders a passive income stream, enhancing the token’s appeal.

Where to Buy SUSHI

SUSHI, the governance and utility token of the SushiSwap ecosystem, is widely available across several major cryptocurrency exchanges, ensuring its accessibility to a broad range of investors. Here are some prominent platforms where you can purchase SUSHI:

- Binance: As one of the largest and most well-known cryptocurrency exchanges globally, Binance offers high liquidity and multiple trading pairs for SUSHI, including against fiat currencies and other cryptocurrencies.

- HTX (formerly Huobi): Known for its robust platform and extensive range of crypto assets, HTX provides a reliable environment for trading SUSHI, with competitive fees and strong market depth.

- MEXC Global: This exchange is favored for its wide selection of tokens and features, such as futures and spot trading. It supports SUSHI trading and often features it in trading competitions and giveaways.

- Bybit: Apart from being a popular platform for derivative trading, Bybit also offers spot trading for cryptocurrencies like SUSHI. It’s known for its user-friendly interface and effective trading tools.

- KuCoin: Known as “the people’s exchange,” KuCoin supports SUSHI and offers a variety of altcoins. The platform is user-friendly and provides a range of services including staking and lending.

- Bitfinex: This exchange is well-regarded among professional traders for its advanced trading features and high liquidity. SUSHI is available for trading with several pairings, enhancing its accessibility.

Where to Store SUSHI Token

For storing SUSHI, a variety of wallets are available, catering to different needs regarding security, convenience, and functionality:

- Metamask: A widely used Ethereum-based wallet, Metamask is ideal for interacting with DeFi applications directly from the browser. It’s suitable for those who frequently trade or participate in DeFi activities on platforms like SushiSwap.

- Trust Wallet: This mobile wallet supports a multitude of cryptocurrencies including SUSHI. It offers a user-friendly interface and the ability to interact with decentralized applications.

- Ledger Nano X/S: For those seeking heightened security, Ledger Nano hardware wallets provide an excellent choice. These devices store your private keys offline, shielding them from online vulnerabilities.

- Trezor: Similar to Ledger, Trezor is a hardware wallet that offers robust security by keeping your tokens offline. Its integration with third-party interfaces also allows for a seamless connection to various DeFi platforms.

- WalletConnect: This open protocol connects desktop wallets to mobile wallets using end-to-end encryption, allowing users to interact securely with SushiSwap or other DeFi services on their mobile devices.

Choosing the right storage solution for SUSHI depends on your specific needs and how you intend to use your tokens. For active trading and frequent DeFi interactions, a combination of hardware and software wallets might be ideal, providing both security and flexibility.

Project Prospects and Development Forecast

The growth of SushiSwap is predicated on its innovative technological solutions within the decentralized finance sector, its expanding user base, and strategic partnerships. The project has carved out a niche by not only providing a decentralized exchange mechanism but also by offering additional features like yield farming, staking, and lending services which attract a wide range of users from individual traders to institutional clients.

Clients and Partners

SushiSwap serves a diverse client base that includes:

- Retail investors who are looking for easy access to a wide range of tokens and the ability to earn returns through liquidity provision and staking.

- Institutional investors who appreciate the decentralized, non-custodial, and permissionless nature of the exchange, allowing them to partake in DeFi with robust security.

- Developers and other DeFi projects looking to integrate with a reliable and established protocol for liquidity and trading services.

Key partnerships that have been instrumental in SushiSwap’s growth include:

- Yearn.finance: Collaboration to enhance yield strategies.

- Chainlink: Integration for reliable, tamper-proof price feeds.

- Polygon: To provide a scalable and cost-effective DeFi environment.

Development Forecast

Looking forward, SushiSwap is likely to continue focusing on innovation within the DeFi space. Anticipated developments include enhancing its scalability by integrating with more layer-2 solutions and possibly developing bespoke blockchain solutions. There is also a potential expansion into newer areas of DeFi such as derivative products and insurance. The success of these initiatives largely depends on continued community support and the adaptation of governance models to meet the evolving needs of the DeFi market.

SushiSwap Ecosystem

The SushiSwap ecosystem comprises several interconnected components that contribute to its comprehensive DeFi platform:

- SushiSwap Exchange: The primary platform for swapping a variety of cryptocurrencies.

- Kashi Lending and Margin Trading: Separate platforms that allow users to lend their assets or engage in margin trading directly on SushiSwap.

- Onsen: A program designed to incentivize the provision of liquidity to selected pools with SUSHI rewards.

- MISO: A launchpad for new projects to auction their tokens and raise liquidity.

- SushiBar (xSUSHI): Where users can stake their SUSHI tokens to earn additional yield from the platform’s fees.

The ecosystem is designed to create a self-sustaining economic environment where each component not only supports the others but also attracts and retains users within the platform. This cohesive ecosystem is fundamental to SushiSwap’s growth strategy, focusing on enhancing user experience and expanding service offerings.

Conclusion

SushiSwap is more than just a DEX; it’s a community-driven platform that seeks to empower its users by offering a decentralized and transparent trading experience. With its innovative approach to DeFi solutions and governance, SushiSwap stands as a notable player in the blockchain ecosystem, poised to adapt and thrive in the ever-evolving cryptocurrency landscape.