This article delves into the intricacies of the Lido DAO project and its native cryptocurrency, LDO. Lido DAO is a leading liquid staking solution designed to make staking accessible and efficient across various blockchain platforms, primarily focusing on Ethereum. Through an in-depth exploration, we will cover the project’s origins, technological framework, tokenomics, ecosystem, and future growth prospects. Readers will gain a comprehensive understanding of how Lido DAO operates, its impact on the cryptocurrency landscape, and its potential trajectory in the evolving blockchain space.

What is Lido DAO?

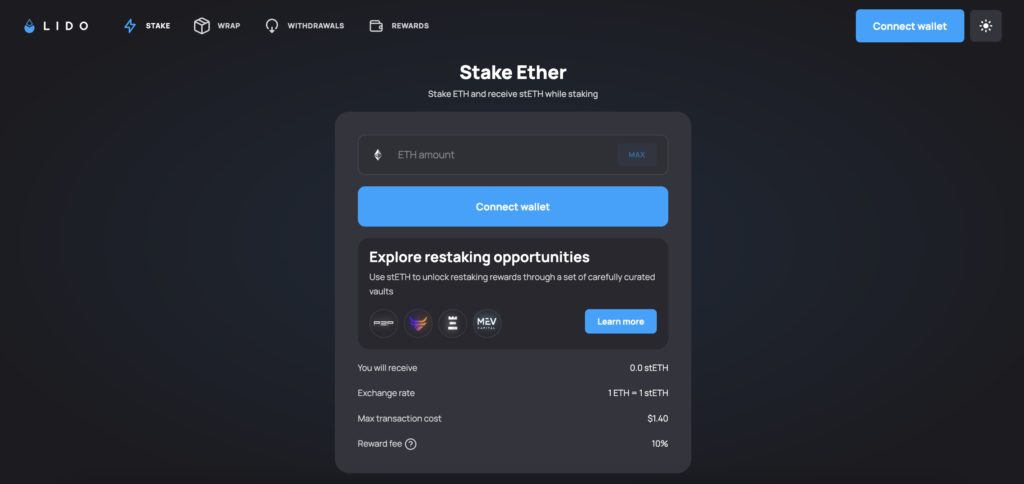

Lido DAO is a decentralized autonomous organization that provides a liquid staking solution for various blockchain platforms, with a primary focus on Ethereum. The project aims to solve the accessibility and liquidity issues inherent in traditional staking mechanisms. By allowing users to stake their assets without locking them up, Lido enables participants to earn staking rewards while maintaining the liquidity of their tokens. This is achieved through the issuance of stTokens, which represent the staked assets and can be freely traded, utilized in DeFi protocols, or redeemed for the original assets. Lido’s innovative approach democratizes staking, making it accessible to a broader range of users and enhancing the overall security and decentralization of the networks it supports.

History of the Project

Lido DAO was established in October 2020, emerging from the collaborative efforts of key figures in the cryptocurrency and blockchain space. The project quickly gained traction due to its unique liquid staking model and its ability to address critical challenges in the staking ecosystem.

Key Milestones in Lido’s Development

- October 2020: Lido DAO is launched, introducing its liquid staking solution on Ethereum.

- January 2021: The LDO governance token is launched, providing the community with the ability to participate in decision-making processes.

- March 2022: Lido raises $70 million in a funding round led by Andreessen Horowitz, bolstering its development and expansion efforts.

- April 2022: Lido expands its services to support additional blockchains, including Polygon, Solana, Polkadot, and Kusama.

- May 2023: Lido V2 is released, introducing the Staking Router, which enhances the diversity of node operators and improves the protocol’s modularity.

- March 2024: Lido becomes a dominant player in the Ethereum staking ecosystem, managing a significant portion of staked ETH.

Throughout its history, Lido DAO has continuously evolved, integrating with various DeFi platforms and expanding its liquid staking services across multiple blockchains. This growth reflects Lido’s commitment to enhancing accessibility, security, and decentralization in the staking landscape.

How Lido DAO Works

Lido DAO operates on a decentralized infrastructure that leverages various technologies to provide a seamless liquid staking experience. At its core, Lido uses smart contracts on the Ethereum blockchain to manage staking, token issuance, and reward distribution. Here’s a detailed breakdown of the technologies and mechanisms that underpin the Lido DAO project:

Core Technologies and Their Roles

- Smart Contracts: Lido’s smart contracts handle the entire staking process. When users stake their assets, the smart contracts mint stTokens, which represent the staked assets. These contracts also manage the distribution of staking rewards and allow users to redeem their stTokens for the underlying assets.

- stTokens: These are liquid representations of the staked assets (e.g., stETH for staked Ether). They can be used in DeFi applications, traded on exchanges, or held in wallets, providing liquidity that traditional staking does not offer.

- Decentralized Node Operators: Lido distributes staked assets across a network of vetted node operators. This decentralization enhances the security and reliability of the staking process, as the risk is spread across multiple operators.

Unique Features and Differentiation

Lido DAO distinguishes itself from other staking solutions through its focus on liquidity and decentralization. Unlike traditional staking, which locks up assets and makes them illiquid, Lido allows users to stake their assets while maintaining liquidity through stTokens. Additionally, Lido’s use of multiple node operators mitigates centralization risks, making the network more robust and secure.

Blockchain and Consensus Mechanism

Lido primarily operates on the Ethereum blockchain, utilizing its Proof of Stake (PoS) consensus mechanism. Here’s a technical overview:

- Ethereum Blockchain: Ethereum’s transition from Proof of Work (PoW) to Proof of Stake (PoS) allows for more energy-efficient and scalable operations. Lido’s integration with Ethereum means it benefits from the blockchain’s security and decentralization.

- Proof of Stake (PoS): In PoS, validators are chosen to propose and validate blocks based on the number of tokens they have staked. This method reduces energy consumption compared to PoW and increases network security as validators have a financial incentive to act honestly.

- Staking Router: Introduced in Lido V2, the Staking Router is a modular framework that allows for the integration of new node operators. It enhances the network’s scalability and decentralization by enabling a diverse set of validators, including solo stakers and DAOs, to participate in the staking process.

Technical Details

- Smart Contract Security: Lido’s smart contracts undergo rigorous audits from top security firms to ensure they are robust and free from vulnerabilities. These audits include checks on the contract logic, security against attacks, and proper implementation of staking and reward mechanisms.

- Governance: Lido’s governance is managed by the LDO token holders, who vote on key decisions such as protocol upgrades, fee structures, and the addition of new node operators. This decentralized governance model ensures that the project evolves in line with the community’s interests.

- Integration with DeFi: Lido’s stTokens are widely integrated with DeFi platforms like Aave, Curve, and others. This integration allows users to leverage their staked assets for additional yield farming, lending, and trading opportunities, further enhancing the utility of Lido’s staking solution.

By leveraging these technologies and mechanisms, Lido DAO provides a unique, user-friendly staking experience that combines liquidity, security, and decentralization, setting it apart from traditional staking solutions.

Tokenomics of Lido DAO

The Lido DAO token (LDO) is the utility and governance token of the Lido DAO ecosystem. Unlike a native cryptocurrency, LDO is an ERC-20 token built on the Ethereum blockchain, designed to facilitate decentralized governance and provide utility within the Lido platform.

Emission Model and Allocation

LDO was launched in December 2020 with a total fixed supply of 1 billion tokens. The distribution of these tokens is as follows:

- DAO Treasury: 36.32%

- Investors: 22.18%

- Validators and Signature Holders: 6.5%

- Initial Developers: 20%

- Founders and Future Employees: 15%

Upon its launch, 64% of the LDO tokens were locked, reserved for founding members and subject to a vesting schedule of one year after an initial one-year lock-up period. The remaining tokens are distributed through airdrops and to the DAO treasury for use in ecosystem development and operational needs.

Governance and Utility

LDO tokens empower holders with voting rights in the Lido DAO, allowing them to participate in governance decisions such as protocol upgrades, fee structures, and the onboarding of new node operators. Voting weight is proportional to the amount of LDO staked, ensuring that governance is influenced by those with significant investment in the project’s success.

Token Performance and Market Presence

The circulating supply of LDO is currently around 879 million tokens, reflecting the gradual release from initial lock-ups and ongoing distribution. LDO tokens can be traded on major cryptocurrency exchanges, and their price fluctuates based on market demand and overall performance of the Lido ecosystem. As of the latest updates, LDO’s price has seen significant volatility, influenced by broader market trends and the adoption of Lido’s liquid staking services.

Unique Features and Comparisons

LDO stands out due to its integral role in Lido’s liquid staking mechanism. Unlike traditional staking, which locks up assets, Lido issues stTokens (e.g., stETH) representing staked assets. These tokens can be used in various DeFi applications, providing liquidity and flexibility while earning staking rewards. This approach differentiates Lido from other staking solutions by combining the benefits of staking with the freedom to use staked assets within the DeFi ecosystem.

Technical Aspects

LDO’s integration with the Ethereum blockchain leverages Ethereum’s security and decentralization. The staking process involves smart contracts that are rigorously audited to ensure security and efficiency. These contracts manage the staking of assets, distribution of rewards, and the minting and burning of stTokens, maintaining a transparent and decentralized staking environment.

Where to Buy LDO Cryptocurrency

LDO, the native token of Lido DAO, can be purchased on several major cryptocurrency exchanges. Here are some of the prominent platforms where LDO is available:

- Binance: One of the largest and most popular cryptocurrency exchanges in the world, Binance offers LDO trading pairs with various cryptocurrencies including USDT and BTC. Binance is known for its high liquidity and comprehensive trading features.

- HTX (formerly Huobi): HTX is a global exchange offering LDO among its extensive list of supported cryptocurrencies. It provides a secure trading environment with a range of tools for both novice and experienced traders.

- MEXC: MEXC is a well-regarded exchange known for listing a wide variety of cryptocurrencies, including LDO. It offers a user-friendly interface and competitive trading fees, making it a good choice for trading LDO.

- Bybit: Bybit is a rapidly growing exchange that has expanded its offerings to include spot trading, where users can buy and sell LDO. It is known for its robust security features and user-centric services.

- KuCoin: KuCoin is a global cryptocurrency exchange that supports LDO. It is popular for its user-friendly interface, a wide range of trading pairs, and various features such as staking and lending.

Where to Store LDO Tokens

Storing your LDO tokens securely is crucial. Here are some recommended wallets that support LDO:

- MetaMask: A popular browser extension and mobile wallet, MetaMask allows users to store and manage their ERC-20 tokens, including LDO. It provides easy access to DeFi applications and DEXs.

- Ledger Nano S and Ledger Nano X: These are hardware wallets that offer enhanced security for storing LDO. They keep your private keys offline and provide robust protection against hacks.

- Trust Wallet: A mobile wallet that supports a wide range of cryptocurrencies, including LDO. Trust Wallet is known for its user-friendly interface and strong security features.

- MyEtherWallet (MEW): A web-based wallet that provides secure access to your Ethereum-based tokens. MEW allows you to interact directly with the Ethereum blockchain and manage your LDO tokens effectively.

- Coinbase Wallet: A mobile wallet developed by Coinbase, it supports ERC-20 tokens like LDO. It offers a simple and secure way to store, send, and receive cryptocurrencies.

Each of these wallets offers unique features and varying levels of security, allowing users to choose the option that best fits their needs for storing LDO tokens.

Prospects of Lido DAO

Lido DAO’s growth is underpinned by its innovative approach to liquid staking, addressing critical issues in the traditional staking landscape such as illiquidity and high entry barriers. The project’s ability to provide staked assets as liquid tokens (stTokens) has attracted a broad user base, from individual stakers to institutional investors, enhancing its market presence and utility.

Growth Drivers

- Increased Adoption of Liquid Staking: As more blockchain networks transition to Proof of Stake (PoS), the demand for liquid staking solutions like Lido is expected to grow. Lido’s capability to provide liquidity while earning staking rewards positions it as a crucial player in this evolving landscape.

- Expansion to Multiple Blockchains: Initially focused on Ethereum, Lido has expanded to support other networks like Solana, Polkadot, and Polygon. This multi-chain strategy not only diversifies risk but also taps into various blockchain communities, driving overall adoption.

- Strong Partnerships: Lido has formed strategic partnerships with major DeFi platforms and projects. Notable partners include Aave, Curve, and Balancer, which integrate Lido’s stTokens into their ecosystems, enhancing their liquidity and use cases.

- Community and Governance: The Lido DAO governance model ensures community involvement in key decisions, fostering a loyal and active user base. This decentralized governance structure enhances trust and aligns with the broader ethos of blockchain technology.

Key Clients and Partners

- Aave: Integration of stTokens for lending and borrowing.

- Curve: Providing liquidity pools for stTokens.

- Balancer: Integration into liquidity pools.

- SushiSwap: DeFi trading platform supporting stTokens.

- Anchorage: Custody services for institutional clients.

Development and Forecast

Lido is positioned for substantial growth, leveraging its technological advantages and strategic expansions. The project’s focus on enhancing staking accessibility and liquidity will likely attract more users and institutional clients. As Ethereum continues to dominate the DeFi space and other PoS networks grow, Lido’s market relevance and influence are expected to increase.

Ecosystem

Lido’s ecosystem encompasses various elements, from stTokens to partnerships with DeFi platforms and wallet providers. This robust ecosystem enhances the functionality and reach of Lido’s staking solutions.

Ecosystem Components

- stTokens: These tokens represent staked assets across different blockchains, providing liquidity and earning staking rewards simultaneously.

- DeFi Integrations: Lido’s stTokens are integrated with major DeFi protocols, enabling users to engage in yield farming, lending, and liquidity provision.

- Wallet Support: Compatibility with popular wallets like MetaMask, Ledger, and Trust Wallet ensures secure and accessible storage options for LDO and stTokens.

- Node Operators: A diverse set of vetted node operators ensures decentralization and security of the staking process.

By continuously expanding its ecosystem and forging strategic partnerships, Lido DAO is set to maintain and enhance its position as a leader in the liquid staking space.

Conclusion

In summary, Lido DAO represents a significant innovation in the realm of liquid staking, offering a versatile platform that bridges the gap between traditional staking and DeFi applications. Its unique approach to decentralization and community governance sets it apart, providing users with both flexibility and security. As the blockchain ecosystem continues to grow, Lido DAO is poised to play a crucial role in shaping the future of staking and decentralized finance.