In this article, we delve into the intricate details of Alchemy Pay (ACH), a pioneering cryptocurrency project designed to bridge the gap between fiat and digital currencies. We will explore the project’s structure, technological framework, tokenomics, and ecosystem. Additionally, we’ll assess its growth prospects and provide a development forecast. By the end of this article, you will have a comprehensive understanding of Alchemy Pay’s role in the evolving landscape of cryptocurrency payment solutions.

What is Alchemy Pay?

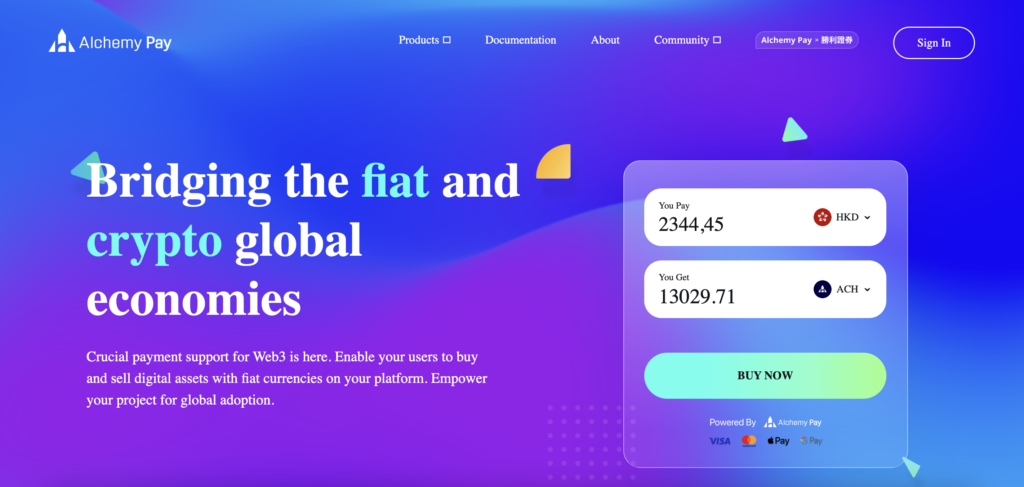

Alchemy Pay is a hybrid payment gateway that integrates traditional fiat currency systems with cryptocurrencies, enabling seamless transactions between the two. Established in 2017, the platform addresses the gap between digital assets and conventional finance by providing fast, low-cost, and secure conversion solutions. It supports payments in both fiat and cryptocurrencies, offering a variety of services including on- and off-ramps, NFT checkout, and crypto payment acceptance systems. Alchemy Pay leverages technologies such as Chainlink’s Price Feed Oracle to ensure real-time, accurate price conversions, making it an effective solution for businesses and consumers alike.

Project History

Founded in Singapore in 2017 by a team of experienced payment industry professionals, Alchemy Pay was created to facilitate easy and efficient integration of cryptocurrency payments into existing fiat systems. Key milestones in its development include:

- 2018: Launched the world’s first hybrid crypto and fiat payment acceptance system.

- 2019: Expanded its services to include on-ramp and off-ramp solutions, enabling users to buy and sell cryptocurrencies with traditional payment methods.

- 2020: Introduced NFT Checkout, allowing users to purchase NFTs using fiat currencies.

- 2021: Established payment touchpoints with over 2 million merchants in 70+ countries.

- 2022: Implemented an Advisory Board Management System to enhance organizational efficiency and compliance, with global experts joining the board to drive strategic decisions.

- 2023: Continued global expansion, focusing on integrating with more payment and remittance partners, and enhancing its direct-to-customer payment solutions.

Throughout its development, Alchemy Pay has maintained a strong focus on mainstream usability, continuously updating its services to meet the needs of both crypto-native users and those less familiar with digital currencies. This has allowed the platform to build a significant presence in the global payments landscape.

How Alchemy Pay Works

Alchemy Pay operates on a hybrid payment gateway system that bridges the gap between traditional fiat currencies and cryptocurrencies. Its technology stack includes decentralized smart contracts, on-chain analytics, and second-layer scaling solutions. This combination ensures that transactions are fast, secure, and cost-effective, making Alchemy Pay a versatile solution for both consumers and businesses.

Technology Stack and Unique Features

Alchemy Pay leverages several key technologies to provide its services:

- Decentralized Smart Contracts: These automate transaction processes and ensure that payment conditions are met without the need for intermediaries.

- On-Chain Analytics: This technology provides real-time tracking and transparency for transactions, enhancing security and trust.

- Second-Layer Scaling Solutions: These are implemented to improve transaction speed and reduce fees, addressing the scalability issues often faced by blockchain networks.

Alchemy Pay distinguishes itself from other payment solutions by offering a seamless integration between fiat and crypto transactions. It supports a wide range of payment methods, including Visa, Mastercard, Apple Pay, Google Pay, and local bank transfers, which can be used to purchase cryptocurrencies through its on-ramp solution. Conversely, its off-ramp solution allows users to convert cryptocurrencies back into fiat and transfer the funds directly to their bank accounts. Additionally, Alchemy Pay offers NFT checkout services, enabling users to buy NFTs with fiat currencies.

Blockchain and Consensus Mechanism

Alchemy Pay’s native token, ACH, operates as an ERC-20 token on the Ethereum blockchain and as a BEP-20 token on the BNB Smart Chain. This dual-network functionality provides flexibility and broad compatibility within the crypto ecosystem.

The consensus mechanism employed by the underlying blockchain technology ensures the security and integrity of transactions. Ethereum’s transition to Proof of Stake (PoS) has enhanced the efficiency and sustainability of the network. In PoS, validators are chosen based on the number of tokens they hold and are willing to “stake” as collateral. This reduces the energy consumption associated with traditional Proof of Work (PoW) mechanisms while maintaining robust security through decentralized validation.

Technical Details

- ERC-20 and BEP-20 Tokens: The ACH token conforms to these standards, ensuring compatibility with Ethereum and BNB Smart Chain wallets and applications.

- Smart Contract Automation: These contracts facilitate various transaction types, including peer-to-peer payments, escrow services, and conditional payments, enhancing functionality and user trust.

- Real-Time Price Feeds: Alchemy Pay integrates with Chainlink’s Price Feed Oracle to provide accurate and reliable exchange rates for crypto-to-fiat conversions.

By integrating these technologies, Alchemy Pay creates a comprehensive and user-friendly payment system that addresses the needs of both crypto enthusiasts and traditional users. This robust infrastructure supports a wide range of transaction types and payment methods, positioning Alchemy Pay as a leading solution in the hybrid payment gateway space.

Tokenomics of Alchemy Pay

Alchemy Pay (ACH) is an ERC-20 token on the Ethereum blockchain and also exists as a BEP-20 token on the BNB Smart Chain. It is designed to facilitate seamless transactions between fiat and cryptocurrencies, providing an integral component to Alchemy Pay’s hybrid payment system.

Token or Coin?

ACH is a token rather than a coin. Unlike coins, which operate on their own native blockchains (like Bitcoin or Ethereum), tokens are built on existing blockchain networks. In this case, ACH operates on both the Ethereum and Binance Smart Chain platforms, utilizing their infrastructure to support its functionality.

Emission Model

The total supply of ACH tokens is capped at 10 billion. The distribution model is designed to incentivize participation and ensure sustainable ecosystem growth. Here’s a breakdown of the token allocation:

- Enterprise and Consumer Transaction Rewards (40%): These tokens are used to reward transactions within the network, encouraging both merchants and consumers to use the platform.

- DeFi Transaction Rewards (11%): Allocated for rewarding participants in decentralized finance activities.

- Transaction Mobility (6%): Reserved for liquidity and transaction flexibility within the ecosystem.

- Enterprise Partners (5%): Set aside for partnerships and strategic alliances.

- Team Allocation (18%): Distributed among the founding team and key developers.

- Marketing and Operations (18%): Used for promotional activities and operational expenses.

- Advisors (2%): Allocated to advisors providing strategic guidance.

Token Functionality

ACH tokens serve multiple roles within the Alchemy Pay ecosystem:

- Transaction Fees: ACH tokens are used to pay for transaction fees on the network, offering a cost-effective solution compared to traditional payment methods.

- Rewards and Incentives: Users and merchants can earn ACH tokens as rewards for participating in the network’s activities, fostering increased engagement and adoption.

- Pledging and Staking: Business partners are required to buy and stake ACH tokens proportional to their network size and transaction volume to access Alchemy Pay’s services. This mechanism ensures commitment and minimizes fraudulent behavior.

- Governance: ACH token holders can participate in governance by voting on key protocol changes and business decisions, contributing to a decentralized decision-making process.

Market Performance

As of recent data, ACH has a circulating supply of approximately 7.6 billion tokens out of the total 10 billion. The market capitalization fluctuates with market conditions, and the token has experienced significant price volatility, typical of cryptocurrencies. Its price has seen substantial highs, such as an all-time high (ATH) of $0.20 in August 2021, but has also faced declines, reflecting broader market trends.

Alchemy Pay’s tokenomics are structured to support a sustainable and scalable payment ecosystem, bridging the gap between traditional fiat systems and emerging digital currencies. The comprehensive distribution and use of ACH tokens ensure that all stakeholders are incentivized to contribute to the network’s growth and stability.

Where to Buy Alchemy Pay (ACH)

Alchemy Pay (ACH) is available for trading on several major cryptocurrency exchanges. Below is a list of popular exchanges where you can purchase ACH tokens:

- Binance: One of the largest and most well-known cryptocurrency exchanges globally, offering a variety of trading pairs including ACH/USDT and ACH/BTC.

- HTX (Huobi): Another major exchange providing a secure platform for trading ACH, with pairs such as ACH/USDT.

- MEXC: Known for its wide range of altcoins, MEXC also supports ACH trading pairs like ACH/USDT.

- Bybit: A rapidly growing exchange with robust trading options, including ACH.

- KuCoin: Offers a comprehensive platform for trading ACH along with various trading pairs.

Where to Store Alchemy Pay (ACH)

To securely store your ACH tokens, you can use a variety of wallets that support ERC-20 and BEP-20 tokens. Here are some recommended options:

- MetaMask: A popular Ethereum wallet that also supports Binance Smart Chain, MetaMask allows you to store, send, and receive ACH tokens. It is available as a browser extension and a mobile app.

- Trust Wallet: A mobile wallet that supports multiple cryptocurrencies, including ACH on both Ethereum and BNB Smart Chain. Trust Wallet offers easy access to decentralized exchanges and DeFi platforms.

- Ledger Nano S/X: Hardware wallets providing high-security offline storage for your ACH tokens. They support a wide range of cryptocurrencies and are compatible with both the Ethereum and BNB Smart Chain networks.

- MyEtherWallet (MEW): An open-source wallet for Ethereum-based tokens, MEW offers a secure way to store and manage your ACH tokens.

- Binance Wallet: If you trade on Binance, you can use the Binance wallet to store your ACH tokens securely within the exchange. It supports seamless integration with the trading platform and additional security features.

These wallets offer various features and levels of security, ensuring that you can choose the best option according to your needs. Always ensure to keep your private keys and recovery phrases secure to avoid any unauthorized access to your assets.

Project Growth Prospects

Alchemy Pay’s growth is underpinned by its innovative hybrid payment solutions, which integrate fiat and cryptocurrency transactions. This unique approach positions Alchemy Pay to address a significant gap in the market by enabling seamless crypto-to-fiat conversions and vice versa, thereby fostering broader adoption of digital currencies.

Clients and Partners

Alchemy Pay’s clientele and partnerships play a crucial role in its expansion strategy. Key partners include:

- Binance: Integration with Binance Pay enables users to transact with merchants globally using Binance’s extensive ecosystem.

- Shopify: Collaboration allows Shopify merchants to accept cryptocurrency payments, broadening the use cases for ACH.

- QFPay: This partnership facilitates crypto payments through a leading mobile payment and digital wallet provider in Asia.

- Arcadier: Enables online marketplaces to accept cryptocurrency payments.

- Tripio: Integrates crypto payments into a blockchain-based hotel booking platform.

These strategic alliances not only enhance Alchemy Pay’s reach but also validate its technology and business model, providing a strong foundation for future growth.

Growth Forecast

The future looks promising for Alchemy Pay, given its continuous efforts to innovate and expand its services. The project’s roadmap includes refining its virtual and physical card solutions and expanding the availability of its services to a broader customer base. With the ongoing development of new payment channels and the enhancement of existing ones, Alchemy Pay is well-positioned to capture a larger market share in the coming years.

Ecosystem

Alchemy Pay’s ecosystem is robust and multifaceted, providing a comprehensive suite of services that cater to various aspects of digital and fiat transactions. Key components of its ecosystem include:

- On-Ramp and Off-Ramp Services: These services enable users to buy cryptocurrencies using traditional payment methods like Visa, Mastercard, Apple Pay, and local bank transfers, and sell cryptocurrencies back to fiat seamlessly.

- NFT Checkout: Allows users to purchase NFTs using fiat currencies, simplifying the process for non-crypto natives.

- Crypto Payment Gateway: Supports a wide range of cryptocurrencies for merchant payments, enhancing the usability and acceptance of digital assets.

- Smart POS: Provides point-of-sale solutions for merchants to accept crypto payments easily and securely.

Alchemy Pay’s ecosystem is designed to be user-friendly and scalable, making it accessible to users of all technical backgrounds and adaptable to various market conditions. This holistic approach ensures that Alchemy Pay can meet the evolving needs of the digital economy and maintain its competitive edge.

By leveraging its strong partnerships, innovative technology, and comprehensive service offerings, Alchemy Pay is poised for sustained growth and increasing adoption across the globe.

Conclusion

As we conclude, it is clear that Alchemy Pay stands out as a significant player in integrating cryptocurrency with traditional financial systems. Its robust infrastructure, innovative solutions, and strategic partnerships position it well for future growth. However, the volatility of the crypto market necessitates careful consideration and continuous monitoring for investors and stakeholders.