In this article, we will explore Enzyme, a decentralized asset management protocol built on the Ethereum blockchain, and its native cryptocurrency, MLN. Enzyme aims to revolutionize traditional asset management by enabling users to create, manage, and invest in on-chain investment vehicles with unparalleled transparency and security. We will delve into the project’s history, technological architecture, tokenomics, ecosystem, and future growth prospects.

What is Enzyme?

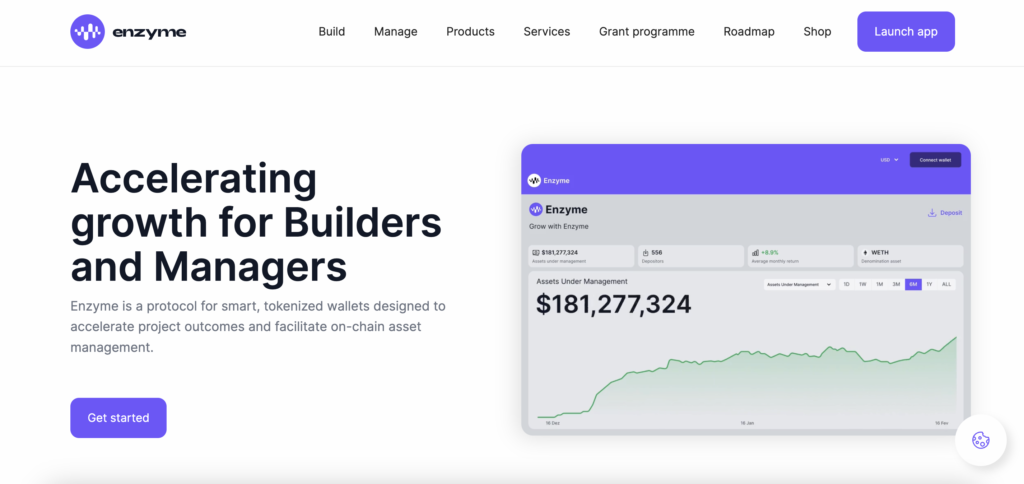

Enzyme, formerly known as Melon Protocol, is a decentralized on-chain asset management platform built on the Ethereum blockchain. The project aims to provide a comprehensive solution for creating, managing, and investing in decentralized investment vehicles. Enzyme facilitates the management of digital assets through a user-friendly interface while ensuring full transparency and security. The platform leverages smart contracts to automate and streamline various aspects of asset management, including fund creation, performance tracking, fee calculations, and compliance with regulatory standards. By offering these functionalities, Enzyme addresses key challenges in traditional asset management, such as high costs, lack of transparency, and limited access to a broad range of investment opportunities.

History of the Project

Enzyme was launched in 2017 as Melon Protocol. The project was developed to bring efficiency and transparency to asset management using blockchain technology. Over the years, Enzyme has undergone significant milestones that have shaped its development and adoption in the DeFi space:

- Launch and Initial Development (2017): Enzyme was initially released as Melon Protocol, focusing on creating a decentralized infrastructure for asset management.

- Mainnet Launch (2018): The protocol went live on the Ethereum mainnet, allowing users to create and manage funds using the platform.

- Rebranding to Enzyme (2020): The project was rebranded from Melon Protocol to Enzyme, reflecting a broader vision and an enhanced platform.

- Integration with Major DeFi Protocols (2020-2021): Enzyme integrated with various DeFi protocols such as Aave, Compound, and Uniswap, enhancing its functionality and offering users access to a diverse set of financial instruments.

- Major Upgrades (2022): The Sulu upgrade introduced significant improvements, including lower gas fees, an updated user interface, and enhanced borrowing capabilities.

- Community and Governance (Ongoing): Enzyme has continually evolved with community input and governance through the Melon Council DAO, ensuring that the platform adapts to the needs of its users and the changing DeFi landscape.

These milestones highlight Enzyme’s commitment to innovation and its role in advancing decentralized asset management solutions.

How Enzyme Works

Enzyme operates on the Ethereum blockchain and leverages a sophisticated set of technologies to provide a decentralized asset management platform. At its core, Enzyme uses smart contracts to automate and streamline the creation, management, and operation of investment funds. These smart contracts handle various critical functions, including asset custody, performance tracking, fee calculations, and compliance, ensuring a transparent and secure environment for both fund managers and investors.

Core Technologies

- Smart Contracts: Enzyme’s functionality is primarily driven by smart contracts. These contracts automate fund management tasks, reducing the need for intermediaries and lowering operational costs. The main smart contracts in the Enzyme protocol include the Vault, which securely stores assets, and the Shares contract, which tracks ownership within a fund.

- Decentralized Oracle Network: Enzyme integrates with decentralized oracles to obtain reliable price feeds and other off-chain data necessary for executing trades and managing assets. This integration ensures that the platform operates with accurate and up-to-date information.

- Interoperability with DeFi Protocols: Enzyme is designed to work seamlessly with a variety of decentralized finance (DeFi) protocols. This interoperability allows users to access a broad range of financial instruments, including lending, borrowing, and liquidity provision through integrations with platforms like Aave, Compound, and Uniswap.

Unique Features

Enzyme distinguishes itself from other asset management platforms through its commitment to transparency, security, and flexibility:

- Transparency: All transactions and fund operations on Enzyme are recorded on the blockchain, providing full visibility to investors and ensuring that fund managers adhere to predefined strategies and rules.

- Security: Enzyme employs rigorous security measures, including regular smart contract audits and a bug bounty program, to safeguard user assets.

- Flexibility: The platform supports a wide range of assets and investment strategies, allowing fund managers to tailor their funds to meet specific investment goals and risk profiles.

Blockchain and Consensus Mechanism

Enzyme is built on the Ethereum blockchain, which uses a Proof of Stake (PoS) consensus mechanism. This transition from Proof of Work (PoW) to PoS, completed with Ethereum 2.0, enhances the network’s scalability, security, and energy efficiency.

- Proof of Stake (PoS): In PoS, validators are chosen to create new blocks and validate transactions based on the number of tokens they hold and are willing to “stake” as collateral. This method is less energy-intensive compared to PoW and helps in achieving faster transaction processing times.

- Smart Contract Deployment: Enzyme’s smart contracts are deployed on Ethereum, leveraging its robust and secure infrastructure. The platform’s contracts are modular and upgradable, allowing for continuous improvement and integration of new features without disrupting existing operations.

Technical Details

- Modular Architecture: Enzyme’s architecture is modular, consisting of various components such as the Hub, Spokes, and Engine contracts. The Hub serves as the core, managing fund creation and tracking, while Spokes handle specific services like asset custody and ownership tracking.

- Security Audits and Bug Bounties: Enzyme conducts thorough security audits and offers substantial bug bounties to ensure the integrity and safety of its platform. Reputable firms like ChainSecurity and OpenZeppelin regularly audit the smart contracts to identify and mitigate potential vulnerabilities.

- Governance: The Enzyme protocol is governed by the Melon Council, a decentralized autonomous organization (DAO). This governance model allows MLN token holders to propose and vote on protocol upgrades, ensuring that the platform evolves according to the community’s needs.

Enzyme’s robust technological foundation, coupled with its emphasis on transparency and security, positions it as a leading platform in the decentralized asset management space.

Tokenomics of Enzyme (MLN)

Enzyme (MLN) is a token, not a coin. The primary distinction between a token and a coin is that a token typically operates on an existing blockchain, while a coin runs on its own native blockchain. MLN operates on the Ethereum blockchain and is used to facilitate various operations within the Enzyme protocol.

Token Supply and Distribution

- Initial Supply: A total of 1,250,000 MLN tokens were created during the initial contribution period.

- Annual Emission: To support ongoing development and operational needs, 300,600 MLN tokens are minted each year.

- Burn Mechanism: The protocol employs a buy-and-burn model where collected network fees, paid in ETH, are converted to MLN and subsequently burned. This reduces the total supply of MLN tokens in circulation, potentially increasing the token’s value over time.

Token Utility

MLN tokens serve several critical functions within the Enzyme ecosystem:

- Governance: MLN holders can participate in the governance of the Enzyme protocol. This includes voting on key issues such as software updates, fee structures, and other protocol-level changes.

- Operational Costs: The tokens are used to pay for transaction costs, performance fees, and management fees associated with running funds on the Enzyme platform.

- Incentives: MLN tokens are also used to incentivize participation in the ecosystem, such as rewarding developers, validators, and other stakeholders who contribute to the network’s growth and security.

Emission Model

The annual emission of 300,600 MLN tokens is designed to ensure that there are sufficient resources for the continued development and operation of the Enzyme protocol. This emission rate is fixed, but the protocol’s buy-and-burn mechanism helps to manage inflation by removing tokens from circulation.

Price Dynamics

The price of MLN tokens is influenced by several factors, including demand for the Enzyme platform, overall market conditions, and the protocol’s tokenomics mechanisms. The buy-and-burn model creates upward pressure on the token’s price by reducing supply. Additionally, the token’s utility in governance and operational costs drives demand, as users need MLN to interact with the platform effectively.

Current Metrics (Example Data)

| Metric | Value |

|---|---|

| Total Supply | 1,250,000 MLN |

| Annual Emission | 300,600 MLN |

| Market Capitalization | $50 million (example) |

| Circulating Supply | 1,100,000 MLN |

| Burned Tokens | 150,000 MLN |

| Current Price | $45.00 per MLN |

*Note: These values are for illustration purposes and should be updated with the latest data from a reliable source.

The combination of a fixed annual emission and a deflationary burn mechanism aims to create a balanced token economy that supports long-term growth and sustainability for the Enzyme platform.

Where to Buy Enzyme (MLN)

Enzyme (MLN) tokens can be purchased on several major cryptocurrency exchanges. Below is a list of prominent exchanges where MLN is actively traded:

- Binance: One of the largest and most popular cryptocurrency exchanges in the world, Binance offers a wide range of trading pairs for MLN, including MLN/USDT, MLN/BTC, and MLN/ETH.

- HTX (formerly Huobi): This exchange provides robust trading options for MLN, allowing users to trade against various cryptocurrencies and stablecoins.

- MEXC: Known for its extensive range of cryptocurrencies, MEXC supports MLN trading with multiple pairs.

- Bitfinex: This exchange offers trading pairs for MLN, providing a secure and user-friendly platform for buying and selling.

- Gate.io: Gate.io is another reputable exchange where MLN is listed, offering several trading pairs and liquidity options.

Where to Store Enzyme (MLN)

Once you have purchased MLN tokens, it is crucial to store them securely. Here are some of the best wallet options for storing MLN:

- Hardware Wallets: These are considered one of the safest options for storing cryptocurrencies. Popular hardware wallets like Ledger Nano S/X and Trezor support MLN, offering robust security features and offline storage.

- Software Wallets: These wallets provide convenient access and are suitable for daily use. Options like MetaMask and Trust Wallet support MLN, allowing users to store, send, and receive tokens with ease.

- Desktop Wallets: Wallets such as Exodus and Atomic Wallet offer a good balance of security and usability, supporting MLN storage on desktop devices.

- Mobile Wallets: For those who prefer to manage their tokens on the go, mobile wallets like Coinomi and Trust Wallet are excellent choices, providing support for MLN on both Android and iOS devices.

- Web Wallets: MyEtherWallet (MEW) and MetaMask also support MLN, allowing users to access their tokens through web interfaces with enhanced security measures.

Wallet Options and Features

| Wallet Type | Wallet Name | Features |

|---|---|---|

| Hardware Wallet | Ledger Nano S/X | Offline storage, high security, multi-asset support |

| Hardware Wallet | Trezor | Secure offline storage, user-friendly interface |

| Software Wallet | MetaMask | Browser extension, DeFi integration, multi-chain support |

| Software Wallet | Trust Wallet | Mobile-friendly, supports multiple blockchains |

| Desktop Wallet | Exodus | User-friendly, multi-asset support, integrated exchange |

| Desktop Wallet | Atomic Wallet | Multi-asset support, staking, built-in exchange |

| Mobile Wallet | Coinomi | Multi-asset support, high security, easy to use |

| Web Wallet | MyEtherWallet (MEW) | Full control of private keys, integrated with hardware wallets |

| Web Wallet | MetaMask | Web interface, easy access to DeFi applications |

Choosing the right wallet depends on your specific needs, such as the level of security you require, ease of access, and whether you plan to use your tokens for daily transactions or hold them long-term.

Project Growth Prospects

Enzyme Finance is poised for significant growth based on several foundational elements. The platform’s ability to provide transparent, secure, and efficient asset management solutions makes it highly attractive in the rapidly evolving DeFi landscape. Key factors driving the growth of Enzyme include its technological innovations, expanding user base, strategic partnerships, and robust governance structure.

Growth Drivers

- Technological Advancements: Enzyme continues to innovate with regular updates and enhancements to its platform. The recent Sulu upgrade introduced lower gas fees, an improved user interface, and additional functionalities like borrowing capabilities. Future updates, such as the Eve upgrade, promise to expand the platform’s capabilities even further.

- Expanding User Base: Enzyme’s user base includes a diverse array of clients such as individual investors, investment clubs, DAO treasuries, and institutional asset managers. The platform’s ability to cater to different investment needs and risk profiles contributes to its growing popularity.

- Strategic Partnerships: Enzyme has formed strategic alliances with several leading DeFi protocols and projects, enhancing its ecosystem and providing users with access to a wide range of financial instruments. Key partners include Aave, Compound, Uniswap, and Yearn Finance.

Clientele and Partners

Clients:

- Individual Investors

- Investment Clubs

- DAO Treasuries

- Institutional Asset Managers

Partners:

- Aave: For lending and borrowing services.

- Compound: Enabling decentralized lending and borrowing.

- Uniswap: Providing liquidity pools and decentralized trading.

- Yearn Finance: Integrating yield optimization strategies.

- Paraswap: Facilitating decentralized exchange services.

- Curve Finance: For stablecoin trading with low slippage.

- Maple Finance: Offering credit protocols.

- Idle Finance: Providing automated yield management.

Growth Forecast

The outlook for Enzyme Finance is positive, with several factors contributing to its potential for continued expansion:

- Market Demand: As the DeFi sector grows, the demand for transparent and efficient asset management solutions like Enzyme is expected to rise.

- Innovation: Continuous technological advancements and platform upgrades will likely attract more users and investors.

- Adoption: Increasing adoption by institutional investors and large-scale asset managers will further solidify Enzyme’s position in the market.

Project Ecosystem

Enzyme’s ecosystem is extensive and interconnected, encompassing a variety of tools, services, and integrations that enhance its functionality and user experience.

Ecosystem Components

- Vaults: Secure storage for digital assets managed on the platform.

- Smart Contracts: Automate and enforce the terms of fund management.

- Decentralized Oracles: Provide accurate and reliable off-chain data for trading and asset management.

- Governance: The Melon Council DAO oversees protocol upgrades and governance, ensuring community-driven development.

Enzyme’s robust and expanding ecosystem, combined with its strategic partnerships, positions it well for sustained growth and innovation in the DeFi space.

Conclusion

Enzyme Finance represents a significant advancement in the realm of decentralized finance (DeFi), providing robust tools for asset management and investment strategies. By leveraging blockchain technology, Enzyme offers a transparent, secure, and flexible environment for both novice and professional investors. As the DeFi landscape continues to evolve, Enzyme’s innovative approach positions it as a key player in the industry’s future.