In this article, we will delve into the details of the Mdex cryptocurrency project and its associated token, MDX. Mdex has emerged as a significant player in the decentralized finance (DeFi) space, leveraging innovative technologies and a robust ecosystem to provide comprehensive financial services. We will explore various aspects of Mdex, including its technological framework, tokenomics, and ecosystem components. Furthermore, we will analyze the growth potential and future prospects of Mdex within the rapidly evolving cryptocurrency landscape.

What is Mdex?

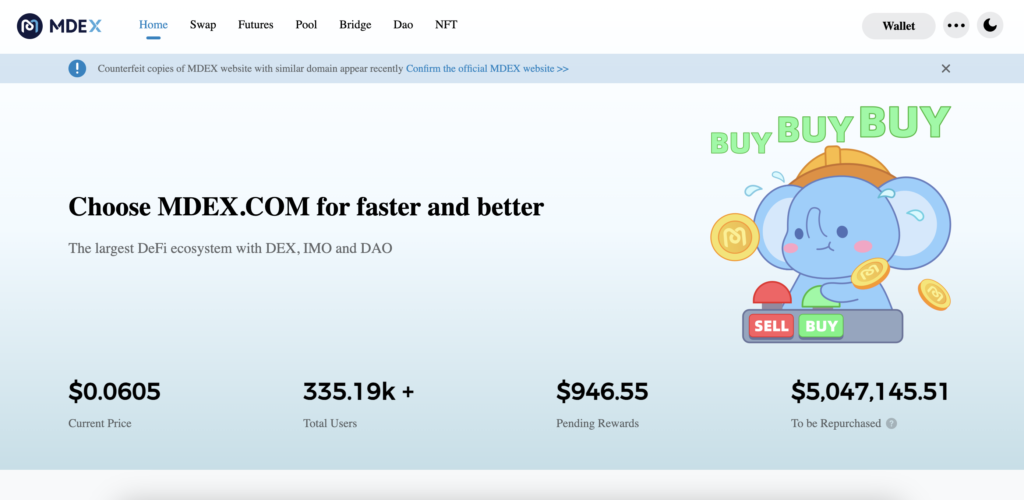

Mdex is a decentralized exchange (DEX) protocol that combines the advantages of multiple blockchains to create an efficient, high-speed trading platform. It operates on a dual-chain model, integrating both Ethereum and Binance Smart Chain (now BNB Smart Chain) to provide users with a versatile trading experience. The core objective of Mdex is to offer a seamless, user-friendly platform for trading digital assets with low fees and high liquidity. By utilizing an automated market maker (AMM) model, Mdex ensures that transactions are quick and cost-effective. Additionally, Mdex incorporates various DeFi services such as yield farming and staking, further enhancing its ecosystem’s value and utility.

Project History

Mdex was launched in January 2021 and quickly gained traction in the DeFi community due to its innovative dual-chain approach. Initially, Mdex focused on building a robust trading platform that could leverage the strengths of both Ethereum and BNB Smart Chain. Key milestones in Mdex’s development include:

- January 2021: Launch of the Mdex platform, introducing the dual-chain model to the DeFi ecosystem.

- February 2021: Implementation of liquidity mining and yield farming features, attracting significant user interest and liquidity.

- March 2021: Integration of the Heco chain, further expanding the platform’s multi-chain capabilities.

- June 2021: Introduction of the Mdex Boardroom, a governance mechanism allowing MDX token holders to participate in decision-making processes.

- 2022-2023: Continuous updates and improvements to the platform, including enhanced security measures, new trading pairs, and partnerships with other DeFi projects.

These milestones reflect Mdex’s commitment to innovation and user-centric development, solidifying its position as a key player in the decentralized finance landscape.

How Mdex Works

Mdex operates on a decentralized exchange (DEX) model, leveraging advanced blockchain technologies to facilitate efficient and secure trading. The platform is built on a dual-chain architecture, integrating Ethereum and Binance Smart Chain (BNB Smart Chain) to optimize performance and accessibility. This hybrid approach allows Mdex to capitalize on the strengths of both blockchains, such as Ethereum’s robust smart contract capabilities and BNB Smart Chain’s lower transaction fees and higher throughput.

Technological Foundations

The core of Mdex’s technology is its Automated Market Maker (AMM) model, which replaces traditional order books with liquidity pools. These pools are funded by users who provide liquidity in exchange for rewards. This mechanism ensures that there is always liquidity for trades, reducing slippage and enabling faster transactions.

Mdex also incorporates yield farming and staking features, where users can earn rewards by locking their assets in the platform’s liquidity pools. These DeFi services are designed to enhance user engagement and liquidity on the platform, making it more attractive to a broader audience.

Unique Features

What sets Mdex apart from other DEXs is its multi-chain strategy and the integration of various DeFi services. The platform supports cross-chain transactions, allowing users to trade assets between different blockchains seamlessly. This capability significantly expands the range of tradable assets and improves liquidity.

Another distinctive feature of Mdex is its governance model, which empowers MDX token holders to participate in decision-making processes. This decentralized governance ensures that the platform evolves in line with the community’s needs and preferences.

Blockchain and Consensus Mechanism

Mdex operates on multiple blockchains, primarily Ethereum and BNB Smart Chain. The consensus mechanisms of these blockchains play a crucial role in ensuring the security and efficiency of the platform.

- Ethereum: Utilizes the Proof of Stake (PoS) consensus mechanism following the Ethereum 2.0 upgrade. PoS enhances scalability and reduces energy consumption compared to the previous Proof of Work (PoW) model. Validators are chosen based on the number of tokens they hold and are willing to “stake” as collateral.

- BNB Smart Chain: Employs the Proof of Staked Authority (PoSA) consensus mechanism, which is a hybrid of PoS and Proof of Authority (PoA). This mechanism combines the efficiency and security of PoA with the decentralized nature of PoS, enabling faster block times and lower transaction fees.

By leveraging these advanced consensus mechanisms, Mdex ensures that its platform remains secure, efficient, and scalable, capable of handling a high volume of transactions while maintaining decentralization and user trust.

Tokenomics of Mdex

Mdex’s native token, MDX, is a utility token that plays a central role within the Mdex ecosystem. Unlike a traditional cryptocurrency coin, which operates on its own blockchain, MDX is a token that exists on multiple blockchains, specifically Ethereum and BNB Smart Chain. This multi-chain presence enhances its liquidity and accessibility.

Emission Model

The MDX token follows an inflationary emission model, designed to incentivize participation in the Mdex ecosystem through various reward mechanisms. Here are the key details of the MDX emission model:

- Initial Supply: At launch, a specific number of MDX tokens were pre-mined.

- Daily Emission Rate: New MDX tokens are generated daily through liquidity mining and staking rewards. This continuous emission is intended to encourage users to provide liquidity and participate in the platform’s governance.

- Emission Reduction: Over time, the emission rate of MDX tokens decreases. This reduction is structured to control inflation and create scarcity, potentially enhancing the token’s value.

Distribution and Allocation

MDX tokens are allocated across different segments to ensure balanced growth and development of the platform:

- Liquidity Mining: A significant portion of MDX tokens is allocated to liquidity providers as rewards. This incentivizes users to contribute to the liquidity pools, ensuring the platform remains robust and functional.

- Staking Rewards: Users who stake their MDX tokens can earn additional MDX as rewards, promoting long-term holding and network stability.

- Development Fund: A portion of the tokens is reserved for ongoing development and improvements to the Mdex platform. This fund ensures that the project can continuously evolve and innovate.

- Community Incentives: To foster a vibrant community, some MDX tokens are allocated for marketing and partnership initiatives.

Token Price and Market Performance

MDX’s market price is subject to fluctuations based on supply and demand dynamics within the broader cryptocurrency market. Factors influencing MDX’s price include:

- Platform Growth: As Mdex expands its user base and introduces new features, the demand for MDX tokens tends to increase, positively impacting its price.

- Market Trends: General trends in the cryptocurrency market, including investor sentiment and regulatory developments, also affect MDX’s price.

Token Allocation Table

| Allocation Category | Percentage of Total Supply |

|---|---|

| Liquidity Mining | 60% |

| Staking Rewards | 20% |

| Development Fund | 10% |

| Community Incentives | 10% |

This structure ensures that the MDX token remains integral to the functioning and growth of the Mdex ecosystem, aligning incentives for all participants and supporting the platform’s long-term vision.

Where to Buy MDX Token

MDX, the native token of the Mdex platform, is widely available for trading on several major cryptocurrency exchanges. These exchanges provide robust trading environments, offering various trading pairs with MDX. Here are the key exchanges where you can buy MDX:

- Binance: One of the largest and most popular cryptocurrency exchanges globally, Binance offers multiple trading pairs for MDX, including MDX/USDT and MDX/BTC.

- HTX (formerly Huobi): Another leading exchange, HTX provides a variety of MDX trading pairs and offers deep liquidity and competitive trading fees.

- MEXC: MEXC is known for its wide range of available cryptocurrencies, including MDX, and offers a user-friendly interface for trading.

These exchanges provide a reliable platform for buying and trading MDX tokens, ensuring accessibility for both novice and experienced traders.

Where to Store MDX Token

Storing your MDX tokens securely is crucial to protect your investment. Several wallets support MDX, offering a range of features to suit different needs. Here are some recommended wallets for storing MDX:

- MetaMask: A widely-used Ethereum wallet that supports MDX on the Ethereum network. MetaMask offers an easy-to-use browser extension and mobile app, making it convenient for managing your tokens.

- Trust Wallet: A mobile wallet that supports multiple blockchains, including Ethereum and BNB Smart Chain. Trust Wallet provides a secure environment for storing MDX and other cryptocurrencies.

- Ledger Nano S/X: Hardware wallets like the Ledger Nano S and X offer the highest level of security by storing your MDX tokens offline. These wallets are ideal for long-term storage and large holdings.

- Coin98 Wallet: A versatile multi-chain wallet that supports MDX on various blockchains. Coin98 offers both mobile and browser extension versions, providing flexibility and convenience.

- MathWallet: Another multi-chain wallet that supports MDX, MathWallet offers a comprehensive suite of tools and features for managing your digital assets securely.

Each of these wallets provides different levels of security and convenience, allowing users to choose the best option based on their storage needs and usage preferences.

Project Growth Prospects

Mdex has shown significant potential for growth based on several key factors. The project’s innovative dual-chain model, combining Ethereum and BNB Smart Chain, positions it uniquely in the DeFi space. This strategic integration allows Mdex to leverage the strengths of both blockchains, offering users lower fees and higher transaction speeds.

Growth Drivers

- Technological Innovation: Mdex’s use of Automated Market Maker (AMM) and cross-chain functionality provides a seamless trading experience, attracting a diverse user base. Continuous improvements and feature additions keep the platform competitive and appealing.

- User Incentives: The platform’s robust yield farming and staking rewards systems attract liquidity providers and investors, contributing to a growing user base and increased liquidity.

- Community Engagement: Decentralized governance through MDX token voting ensures that the project evolves according to community needs and preferences, fostering a strong and loyal user community.

Clients and Partners

Mdex’s clientele includes individual traders, liquidity providers, and institutional investors seeking efficient and cost-effective trading solutions. The project has also established several key partnerships to enhance its ecosystem:

- Binance: Provides liquidity and trading pairs for MDX.

- HTX (Huobi): Supports MDX trading and integrates with the Mdex platform.

- MEXC: Offers a wide range of trading pairs and deep liquidity for MDX.

Development Forecast

The outlook for Mdex is promising, with several factors contributing to its anticipated growth:

- Market Expansion: As the DeFi market continues to expand, Mdex is well-positioned to capture a significant share due to its innovative features and strong user base.

- Technological Advancements: Ongoing upgrades and the integration of new technologies will likely enhance platform efficiency and user experience.

- Increased Adoption: Growing adoption of DeFi and cross-chain trading solutions will drive more users to Mdex, boosting liquidity and trading volumes.

Ecosystem

The Mdex ecosystem is comprehensive, encompassing various components that work together to create a robust and versatile DeFi platform. Key elements of the ecosystem include:

- Liquidity Pools: Core to the AMM model, these pools ensure that there is always liquidity for trades.

- Yield Farming and Staking: Users can earn rewards by providing liquidity or staking their MDX tokens, enhancing the ecosystem’s value.

- Governance: MDX token holders participate in governance, influencing key decisions and the platform’s future direction.

- Mdex Boardroom: A governance mechanism that allows MDX holders to stake their tokens and participate in decision-making processes.

- Cross-Chain Functionality: Supports seamless trading across multiple blockchains, enhancing asset accessibility and liquidity.

Ecosystem Components

| Component | Description |

|---|---|

| Liquidity Pools | Ensure continuous liquidity for trades |

| Yield Farming and Staking | Provide incentives for users to lock assets in the ecosystem |

| Governance | Allows MDX holders to participate in platform decision-making |

| Mdex Boardroom | A dedicated space for governance and staking activities |

| Cross-Chain Functionality | Enables trading across Ethereum and BNB Smart Chain |

The Mdex ecosystem’s comprehensive nature and innovative features contribute significantly to its growth and sustainability, making it a pivotal player in the DeFi landscape.

Conclusion

Mdex and its MDX token represent a compelling case within the DeFi sector, demonstrating significant potential through its technological advancements and strategic ecosystem development. By examining the intricacies of Mdex, we gain insights into how such projects are shaping the future of finance. As the cryptocurrency market continues to mature, the evolution and impact of Mdex will be crucial to observe, offering valuable lessons and opportunities for stakeholders and enthusiasts alike.