This article delves into the intricacies of Keep3rV1 and its associated cryptocurrency, KP3R. We will explore the project’s inception, technological foundation, tokenomics, ecosystem, growth prospects, and future outlook. Keep3rV1, developed by renowned blockchain engineer Andre Cronje, aims to solve the operational challenges faced by decentralized applications (dApps) through a decentralized network of keepers. These keepers are incentivized to perform tasks critical to the smooth functioning of various blockchain-based systems. By examining these elements, we aim to provide a comprehensive understanding of Keep3rV1 and its role within the broader cryptocurrency landscape.

What is Keep3rV1?

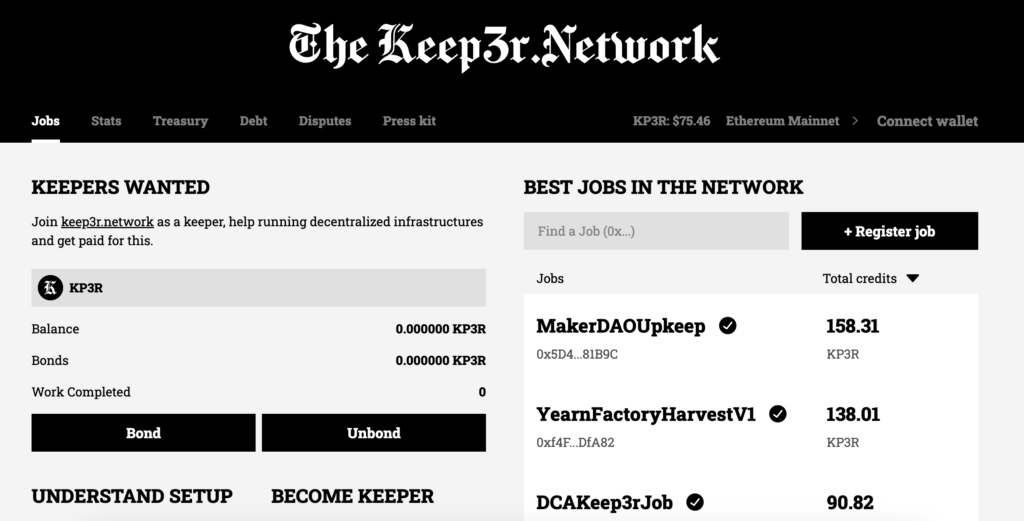

Keep3rV1 is a decentralized job-matching platform designed to connect external DevOps with blockchain projects that require assistance in completing various operational tasks. The core function of Keep3rV1 is to serve as a decentralized network where “Keepers” perform tasks such as executing transactions and managing smart contracts on behalf of other projects. These keepers can be individuals, teams, or automated bots, and they are rewarded with the platform’s native token, KP3R, for their contributions. By outsourcing these tasks, blockchain projects can maintain their operational efficiency and focus on core development activities.

History of the Project

Keep3rV1 was founded in late 2020. Since its inception, the project has marked several significant milestones. Initially launched as a response to the growing need for reliable and decentralized operational support within the blockchain ecosystem, Keep3rV1 quickly garnered attention. Shortly after its launch, the project experienced rapid growth in liquidity and user engagement. Over the subsequent months, Keep3rV1 underwent several updates to enhance its platform capabilities and security features, including audits by reputable blockchain security firms. The platform’s token, KP3R, also saw listings on major cryptocurrency exchanges, increasing its accessibility and liquidity.

How Keep3rV1 Works

Keep3rV1 operates as a decentralized job-matching platform that leverages blockchain technology to connect projects requiring operational tasks with external actors, known as Keepers. The core technology behind Keep3rV1 involves the use of smart contracts, which automate the job posting and execution process. Here’s a closer look at how it works and the technologies involved:

Underlying Technologies

Keep3rV1 is built on the Ethereum blockchain, utilizing its robust infrastructure to ensure security and decentralization. Smart contracts are central to Keep3rV1’s operation. These self-executing contracts contain the terms of the agreement directly written into code, allowing for automatic execution and verification of tasks without intermediaries.

Projects needing tasks performed submit their requirements through a smart contract. Keepers, who can be individuals, teams, or automated bots, interact with these contracts to complete the specified tasks. For their services, Keepers are rewarded with the platform’s native token, KP3R.

Unique Features and Differentiation

What sets Keep3rV1 apart from other decentralized platforms is its specific focus on operational task management within the blockchain ecosystem. Unlike general-purpose blockchain platforms, Keep3rV1 is designed to address the niche need for external task execution, which is crucial for maintaining the functionality of decentralized applications (dApps) and other blockchain projects.

The platform’s decentralized approach ensures that tasks are distributed among numerous Keepers, reducing the risk of centralization and enhancing the reliability and resilience of the task execution process. Additionally, Keep3rV1’s use of bonded Keepers, who must lock up KP3R tokens to participate, ensures that participants have a vested interest in the system’s integrity and performance.

Blockchain and Consensus Mechanism

Keep3rV1 operates on the Ethereum blockchain, which initially used the Proof of Work (PoW) consensus mechanism. PoW requires network participants (miners) to solve complex mathematical problems to validate transactions and add new blocks to the blockchain. This method, while secure, is energy-intensive.

Ethereum has been transitioning to Proof of Stake (PoS) through its Ethereum 2.0 upgrade. In PoS, validators are chosen to create new blocks and validate transactions based on the number of tokens they hold and are willing to “stake” as collateral. This transition aims to reduce energy consumption while maintaining the network’s security and decentralization. Validators in a PoS system are incentivized through rewards distributed in the form of transaction fees or newly minted tokens.

Technical Details

- Smart Contracts: Integral to the Keep3rV1 platform, smart contracts automate job posting, execution, and payment processes.

- KP3R Token: The native token used for rewarding Keepers. KP3R can be earned, staked, and traded within the platform.

- Bonded Keepers: Participants who lock KP3R tokens to gain the ability to perform tasks. This ensures a commitment to the network’s integrity and operational efficiency.

By combining these technological elements, Keep3rV1 provides a robust solution for decentralized task management, offering scalability, security, and efficiency within the blockchain ecosystem.

Tokenomics of Keep3rV1

Keep3rV1 utilizes the KP3R token, an ERC-20 token based on the Ethereum blockchain, primarily used for governance and rewarding Keepers within the network. KP3R is not a standalone cryptocurrency like Bitcoin but rather a utility token specific to the Keep3rV1 ecosystem.

Emission Model

Unlike many other tokens, KP3R does not have a predetermined supply limit. The token is minted dynamically when liquidity is added to the platform through Uniswap, which means new tokens are created in response to liquidity needs rather than through a fixed issuance schedule. This model helps maintain a balance between token availability and platform demand, aligning incentives for liquidity providers and users.

Circulating Supply and Market Performance

As of now, the total supply of KP3R stands at approximately 493,731 tokens. The market capitalization fluctuates based on the token’s trading price, which recently has been around $76.46. The token experienced significant volatility, with historical price highs nearing $1,940.39 and lows around $41.23. This volatility is typical in the DeFi space, influenced by broader market trends and specific platform developments.

Use Cases and Governance

KP3R tokens are integral to the functioning of the Keep3rV1 platform. Keepers must bond KP3R tokens to take on jobs, which helps ensure their commitment and reliability. These bonded tokens also participate in governance, allowing holders to vote on key decisions regarding the platform’s future.

Economic Incentives

The economic design of KP3R incentivizes active participation. Keepers earn KP3R tokens as rewards for completing jobs, which can be staked to earn additional rewards or used to increase their reputation and job access within the network. This creates a virtuous cycle where active and reliable participation is rewarded with greater earning potential and governance influence.

Price Dynamics

KP3R’s price dynamics reflect both its utility within the Keep3rV1 ecosystem and broader market sentiments. The token’s value can be significantly affected by market trends in DeFi and overall cryptocurrency market conditions. Additionally, the supply mechanism through Uniswap liquidity provision means that market conditions can directly influence token issuance and availability.

In conclusion, KP3R’s tokenomics are designed to create a balanced, incentive-driven ecosystem that supports the operational needs of blockchain projects while providing meaningful economic incentives for participants. This dynamic approach to token supply and demand, coupled with its governance and reward structures, positions Keep3rV1 as a robust player in the decentralized task management space.

Where to Buy KP3R Cryptocurrency

KP3R, the native token of the Keep3rV1 network, can be purchased on several major cryptocurrency exchanges. Below is a list of exchanges where you can buy KP3R:

- Binance is one of the largest and most popular cryptocurrency exchanges globally. It offers a wide range of trading pairs and robust security features. KP3R can be traded against various pairs, including USDT and ETH.

- MEXC is a well-regarded exchange that provides access to a diverse range of cryptocurrencies. It supports KP3R trading and is known for its user-friendly interface and competitive fees.

- BingX, primarily known for its derivatives trading, also offers spot trading for KP3R. It provides a secure and efficient trading environment with high liquidity and advanced trading features.

- Bitget is a popular exchange that supports a wide array of cryptocurrencies, including KP3R. It offers a variety of trading pairs and is known for its comprehensive range of features and high security standards.

Where to Store KP3R Tokens

Storing your KP3R tokens securely is crucial. Below are some recommended wallets that support ERC-20 tokens like KP3R, along with their features:

- MetaMask is a widely used browser extension wallet that supports all ERC-20 tokens. It provides a user-friendly interface, secure key storage, and easy access to decentralized applications (dApps).

- Trust Wallet is a mobile wallet that supports multiple blockchains and tokens, including ERC-20 tokens like KP3R. It offers robust security features, a simple interface, and integration with various dApps.

- Ledger Nano S and Ledger Nano X are hardware wallets known for their top-notch security. They store your private keys offline, making them less susceptible to hacks. Both models support ERC-20 tokens via the Ledger Live application.

- MyEtherWallet is an open-source, client-side wallet that supports Ethereum and ERC-20 tokens. It allows users to generate wallets and interact with the Ethereum blockchain securely.

- Trezor is another reputable hardware wallet that offers high security for storing cryptocurrencies. It supports ERC-20 tokens and integrates with MyEtherWallet for easy token management.

By using these wallets, you can ensure that your KP3R tokens are stored securely and accessible when needed. Each option provides different levels of security and convenience, allowing you to choose the one that best fits your needs.

Project Growth Prospects

Basis for Growth

The growth of Keep3rV1 is underpinned by its unique position in the DeFi space, providing critical infrastructure for decentralized task management. The project’s growth relies on increasing adoption by blockchain projects that require reliable external actors to perform essential tasks. Keep3rV1 addresses a significant need for decentralized applications (dApps) that manage complex systems and smart contracts, ensuring operational efficiency without relying on centralized services.

Clients and Partners

The primary clients of Keep3rV1 are decentralized finance (DeFi) protocols and other blockchain projects that need tasks performed, such as transaction execution and smart contract maintenance. The platform facilitates these operations through a decentralized network of Keepers. Some notable partners include:

- Yearn.Finance: As the brainchild of the same founder, Andre Cronje, Yearn.Finance integrates with Keep3rV1 for task automation and management.

- Sushiswap: A decentralized exchange that can utilize Keep3rV1’s network for executing complex financial operations.

- Other DeFi Projects: Various unnamed DeFi projects leverage Keep3rV1’s infrastructure to enhance their operational capabilities.

Development Forecast

The future of Keep3rV1 looks promising, with several factors contributing to its potential growth:

- Expanding Use Cases: As the DeFi ecosystem grows, the need for decentralized task management solutions like Keep3rV1 will increase.

- Ecosystem Integration: Continued integration with more DeFi projects and platforms will drive demand for KP3R tokens and expand the network of Keepers.

- Technological Advancements: Ongoing enhancements to the platform’s technology and security features will bolster its adoption and reliability.

Analysts predict that as the DeFi sector matures, Keep3rV1 will play an increasingly critical role in maintaining the operational efficiency of decentralized platforms, potentially driving significant appreciation in KP3R’s value.

Project Ecosystem

Ecosystem Overview

The Keep3rV1 ecosystem is designed to facilitate efficient task management for decentralized projects. It includes various components that work together to ensure seamless operation:

- Keepers: The backbone of the ecosystem, Keepers are individuals, teams, or bots that perform tasks for projects within the network.

- KP3R Token: The native ERC-20 token used to reward Keepers and participate in governance.

- Smart Contracts: Used to automate and manage task assignments and rewards within the network.

Ecosystem Components

Here is a more detailed look at the key components of the Keep3rV1 ecosystem:

- Bonding Mechanism: Keepers bond KP3R tokens to be eligible to perform tasks. This mechanism ensures that Keepers have a vested interest in the network’s success.

- Governance: KP3R holders can participate in the governance of the platform, voting on proposals that affect the development and management of the network.

- Reward System: Keepers are rewarded in KP3R tokens for successfully completing tasks, incentivizing active participation and reliability.

By leveraging these components, Keep3rV1 provides a robust and scalable solution for decentralized task management, supporting the broader DeFi ecosystem’s growth and development.

Conclusion

In summary, Keep3rV1 represents a significant innovation in the realm of decentralized task management for blockchain projects. Its unique approach to incentivizing keepers to perform essential maintenance tasks addresses a critical need within the rapidly evolving DeFi space. As the ecosystem continues to grow and develop, the potential for Keep3rV1 to become an integral component of blockchain infrastructure becomes increasingly apparent. By focusing on the technical details and economic implications of the project, this article provides a detailed overview of what Keep3rV1 has to offer and its potential impact on the future of decentralized finance.