In this article, we will delve into the intricacies of the cryptocurrency project Trader Joe and its native token, JOE. Trader Joe is a decentralized exchange (DEX) built on the Avalanche blockchain, offering a comprehensive suite of DeFi services, including trading, yield farming, and staking. This article will explore the project’s history, technological architecture, tokenomics, ecosystem, growth prospects, and future development. Our goal is to provide a thorough understanding of Trader Joe and the potential impact of the JOE token in the rapidly evolving DeFi landscape.

What is Trader Joe?

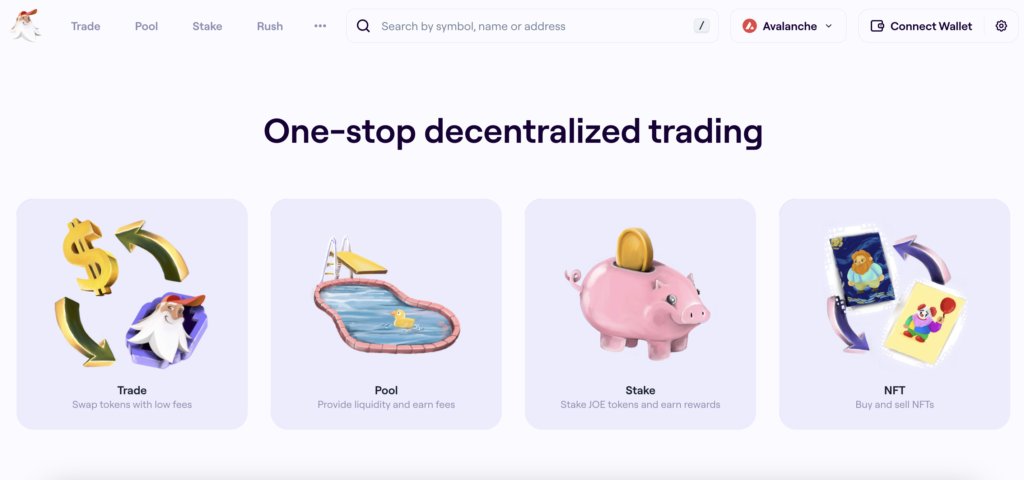

Trader Joe is a decentralized exchange (DEX) built on the Avalanche blockchain. It offers a suite of DeFi services, including token trading, yield farming, staking, and lending. The platform integrates various decentralized finance functions to provide users with a comprehensive trading experience. By leveraging the high-speed, low-cost transactions enabled by Avalanche, Trader Joe aims to enhance the efficiency and accessibility of DeFi activities. The core objective of the project is to create a one-stop DeFi platform where users can trade, provide liquidity, farm yields, and access lending services, all within a single ecosystem.

History of the Project

Trader Joe was launched in June 2021, aiming to provide a robust DEX within the Avalanche ecosystem. Shortly after its inception, the platform gained traction due to its user-friendly interface and the efficiency of the Avalanche network. Key milestones in its development include:

- June 2021: Launch of Trader Joe on the Avalanche blockchain.

- Q3 2021: Introduction of liquidity mining and yield farming features, attracting significant total value locked (TVL).

- Q4 2021: Integration of the Banker Joe lending protocol, enabling users to borrow and lend assets in a decentralized manner.

- 2022: Expansion of platform features to include leveraged trading and additional DeFi services, enhancing the utility of the JOE token.

- 2023: Continuous development focused on improving platform security, user experience, and expanding the range of supported assets and trading options.

Throughout its history, Trader Joe has been recognized for its rapid innovation and ability to adapt to the evolving DeFi landscape, solidifying its position as a key player on the Avalanche network.

How Does Trader Joe Work?

Trader Joe operates as a decentralized exchange on the Avalanche blockchain, leveraging various cutting-edge technologies to provide a seamless DeFi experience. The platform integrates several core components, each playing a critical role in its functionality and differentiating it from other DEXs.

Underlying Technologies

Trader Joe is built on the Avalanche blockchain, known for its high throughput and low latency. Avalanche’s unique architecture allows Trader Joe to offer fast and cost-effective transactions, a crucial advantage over many other DEXs operating on more congested blockchains.

Automated Market Maker (AMM) Model

Trader Joe employs an Automated Market Maker (AMM) model, similar to Uniswap, where liquidity pools are used instead of traditional order books. Users can trade against these liquidity pools, providing liquidity in exchange for trading fees and rewards in the form of JOE tokens. This model ensures constant liquidity and efficient price discovery, even for less liquid assets.

Banker Joe Protocol

One standout feature is the Banker Joe lending protocol, which enables users to lend and borrow assets in a non-custodial manner. Based on the Compound protocol, Banker Joe allows users to earn interest on their deposits or borrow against their holdings with over-collateralized loans. This functionality expands the utility of the platform beyond simple trading and liquidity provision.

Consensus Mechanism

Avalanche utilizes a unique consensus mechanism called Avalanche consensus, which is based on a Directed Acyclic Graph (DAG) protocol. Unlike traditional Proof of Work (PoW) or Proof of Stake (PoS) systems, Avalanche consensus allows for high scalability and quick finality, processing thousands of transactions per second with minimal confirmation times.

Technical Details

- High Throughput and Low Latency: Avalanche can process up to 4,500 transactions per second (TPS), significantly higher than Ethereum’s current capacity. This high throughput ensures that Trader Joe can handle a large volume of trades without delays.

- Scalability: The DAG structure allows the network to scale efficiently as more validators join, maintaining performance without the bottlenecks typical of linear blockchain structures.

- Security and Decentralization: Avalanche’s consensus protocol is designed to be robust against attacks, with its decentralized structure ensuring no single point of failure. The network’s security is further enhanced by its large and diverse set of validators.

Differentiation from Other Projects

Trader Joe sets itself apart through its integration within the Avalanche ecosystem, which provides it with inherent advantages in terms of transaction speed and cost. Additionally, the comprehensive suite of DeFi services available on Trader Joe, from trading to lending and yield farming, offers users a versatile platform. Its emphasis on continuous innovation and user-centric features, such as single-click token swaps (Zap) and a robust lending protocol, further distinguishes it from other DEXs in the market.

Overall, Trader Joe’s combination of advanced technologies and strategic focus on usability and efficiency positions it as a leading player in the DeFi space.

Tokenomics of Trader Joe

The Trader Joe platform utilizes the JOE token, which is an ARC-20 token on the Avalanche blockchain. The primary function of JOE is to serve as a utility and governance token within the Trader Joe ecosystem, facilitating various DeFi operations and community decision-making processes.

Token or Coin?

JOE is a token, not a coin. The distinction lies in the fact that JOE operates on the Avalanche blockchain rather than its own native blockchain, which classifies it as a token. Coins typically refer to cryptocurrencies that are native to their own blockchain (e.g., Bitcoin, Ethereum).

Emission Model and Distribution

The total supply of JOE is fixed at 500 million tokens. The emission model is designed to gradually decrease the rate of new token issuance over time, with all tokens expected to be emitted by early 2024. The distribution of JOE tokens is structured to support various stakeholders and platform functions.

Token Distribution:

| Allocation | Percentage | Notes |

|---|---|---|

| Liquidity Providers | 50% | Incentivizes users to provide liquidity. |

| Treasury | 20% | Used for platform development and operations. |

| Team | 20% | Three-month cliff for vesting. |

| Future Investors | 10% | Reserved for strategic investment rounds. |

Utility and Governance

JOE tokens have multiple utilities within the Trader Joe platform:

- Staking: Users can stake JOE to earn xJOE, which entitles them to a share of the platform’s revenue, including trading fees and interest from lending activities.

- Liquidity Mining: Participants in liquidity pools are rewarded with JOE tokens, incentivizing the provision of liquidity.

- Governance: JOE token holders can vote on governance proposals, influencing the future development and policies of the platform.

Price and Market Performance

The price of JOE has seen significant fluctuations since its launch, reflecting broader market trends and the platform’s development milestones. Here’s a brief overview of its historical price performance and future projections:

Historical Price Data:

| Year | Minimum Price | Maximum Price | Average Price |

|---|---|---|---|

| 2021 | $0.50 | $2.50 | $1.50 |

| 2022 | $0.80 | $3.00 | $1.90 |

| 2023 | $1.20 | $4.00 | $2.60 |

Future Projections:

| Year | Minimum Price | Maximum Price | Average Price |

|---|---|---|---|

| 2024 | $2.50 | $5.00 | $3.75 |

| 2025 | $3.00 | $6.50 | $4.75 |

| 2026 | $3.50 | $7.00 | $5.25 |

These projections are based on market analysis and the platform’s anticipated growth, including new feature rollouts and increased adoption within the DeFi space.

Economic Model and Incentives

The economic model of Trader Joe is designed to create a self-sustaining ecosystem. By rewarding liquidity providers and stakers, the platform ensures continuous participation and engagement from its community. The gradual reduction in token emission rates is intended to create scarcity, potentially increasing the value of JOE over time. Additionally, the integration of governance features ensures that token holders have a direct say in the platform’s evolution, aligning their interests with the long-term success of Trader Joe.

Where to Buy JOE Cryptocurrency

JOE, the native token of the Trader Joe platform, is available on several major cryptocurrency exchanges. Here is a list of some of the prominent exchanges where you can purchase JOE:

- Binance: One of the largest and most popular cryptocurrency exchanges globally, Binance offers a wide range of trading pairs and high liquidity for JOE.

- HTX (formerly Huobi): This exchange is well-known for its extensive selection of cryptocurrencies and strong security measures.

- MEXC: A fast-growing exchange that provides various trading options and a user-friendly interface.

- BingX: Known for its derivatives trading, BingX also supports spot trading of JOE.

- Gate.io: Offers a comprehensive suite of trading tools and a wide range of cryptocurrencies, including JOE.

To buy JOE on these platforms, you need to create an account, complete any required verification processes, and deposit funds. You can then trade JOE against other cryptocurrencies like USDT, BTC, or ETH.

Where to Store JOE Tokens

Storing your JOE tokens securely is crucial to ensure their safety. Here are some recommended wallets for storing JOE tokens:

- MetaMask: A widely used Ethereum wallet that also supports the Avalanche blockchain. It allows you to store, send, and receive JOE tokens easily.

- Trust Wallet: A mobile wallet that supports multiple cryptocurrencies and blockchains, including Avalanche. It provides a user-friendly interface and robust security features.

- Ledger Nano S/X: Hardware wallets that offer the highest level of security for storing your JOE tokens. They support Avalanche and provide offline storage, making them less vulnerable to online attacks.

- Avalanche Wallet: The official wallet for the Avalanche network, specifically designed to support Avalanche-based tokens like JOE. It offers features tailored for interacting with the Avalanche ecosystem.

Each of these wallets provides a combination of security, ease of use, and functionality. MetaMask and Trust Wallet are excellent for everyday use and quick access, while Ledger hardware wallets are ideal for long-term, secure storage. The Avalanche Wallet is particularly useful for those who frequently interact with the Avalanche blockchain and its native applications.

Project Prospects

Trader Joe’s growth is founded on its innovative use of technology and strategic positioning within the DeFi landscape. As the largest decentralized exchange on the Avalanche blockchain, it leverages the high throughput and low latency of Avalanche to offer a superior user experience. The project’s growth is driven by its comprehensive suite of DeFi services, continuous innovation, and strong community engagement.

Clients and Partners

Trader Joe caters to a diverse range of clients, from individual crypto enthusiasts to institutional investors looking for efficient DeFi solutions. The platform’s clients benefit from its diverse features, including trading, yield farming, and lending. Key partners and backers of Trader Joe include:

- Three Arrows Capital

- Avalanche

- Coin98 Ventures

- Delphi Digital

- AAVE founder Stani Kulechov

- Darren Lau

These partnerships provide strategic support and contribute to the platform’s credibility and expansion.

Development Forecast

The future development of Trader Joe is centered around several key areas:

- Expansion of DeFi Services: Introduction of new financial instruments like options and futures trading to enhance the platform’s functionality.

- Scalability Improvements: Ongoing enhancements to the Avalanche network to maintain high performance and low transaction costs.

- User Experience: Continuous improvements to the user interface and the addition of more intuitive features for both novice and experienced users.

- Community Governance: Increased involvement of the JOE token holders in governance decisions, ensuring the platform evolves in line with the community’s needs.

Ecosystem

Trader Joe is more than just a DEX; it is a comprehensive DeFi ecosystem with various interconnected components that enhance its overall utility and user engagement.

Ecosystem Components:

- Trading Platform: A robust and user-friendly interface for swapping a wide range of tokens.

- Liquidity Pools: Incentivized pools where users can provide liquidity and earn rewards in JOE tokens.

- Banker Joe: A lending and borrowing protocol that allows users to lend and borrow assets in a decentralized manner.

- Yield Farming: Opportunities for users to stake their tokens and earn yields.

- xJOE Staking: A mechanism where users can stake JOE to earn a share of the platform’s revenue.

Overall, Trader Joe’s ecosystem is designed to be a one-stop solution for DeFi users, offering a comprehensive range of services that cater to various financial needs within the crypto space. The continuous development and integration of new features will likely drive further adoption and growth.

Conclusion

Trader Joe represents a significant player in the decentralized finance space, particularly within the Avalanche ecosystem. With its innovative features and strong community support, it has positioned itself as a leading DEX. As we have explored, the project’s comprehensive approach to DeFi services, coupled with the utility and governance capabilities of the JOE token, underscores its potential for sustained growth and influence in the market. The ongoing development and strategic enhancements signal a promising trajectory for both the platform and its users.