Curve is a decentralized finance (DeFi) platform that focuses on providing efficient stablecoin trading with low slippage and minimal fees. Launched in early 2020, Curve has rapidly become a cornerstone of the Ethereum-based DeFi ecosystem, leveraging liquidity pools and automated market making (AMM) to facilitate trading.

Project History

Curve was founded by Michael Egorov, a Russian scientist with a background in physics and technology. The project quickly distinguished itself in the DeFi space by targeting a niche yet critical area: stablecoin exchanges. Curve’s development has been marked by its community-driven approach, with governance token holders playing a significant role in decision-making processes. Significant milestones include the introduction of the CRV token, integration with multiple blockchains, and partnerships with major DeFi projects.

What is Curve?

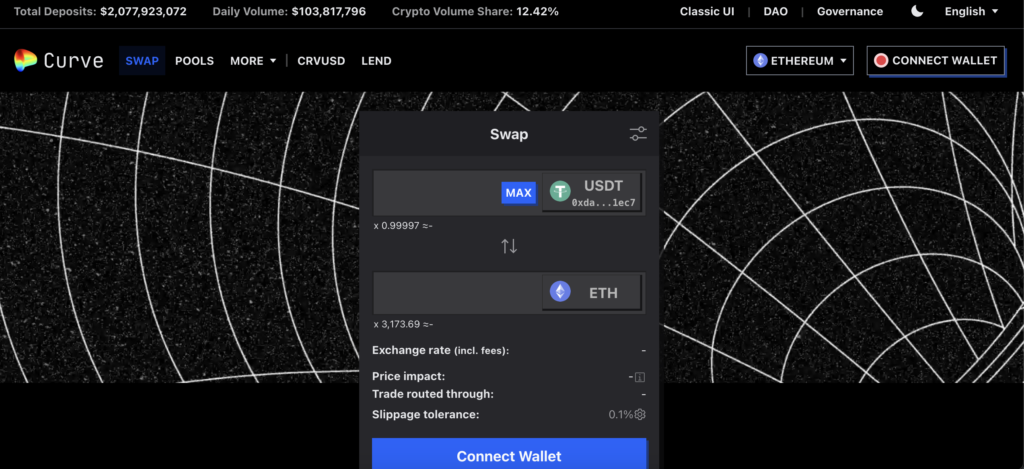

Curve is a decentralized exchange (DEX) designed to trade stablecoins using an automated market maker model to manage liquidity. By focusing on stablecoins, Curve reduces impermanent loss—a common issue in liquidity pools with volatile assets. The platform addresses the needs for rapid and cost-effective stablecoin transactions, which are crucial for arbitrageurs, traders, and other financial actors within the DeFi ecosystem.

How Curve Works?

Curve’s technological infrastructure is deeply integrated with the Ethereum blockchain, leveraging its robust features for decentralized applications (dApps) and smart contracts. The project utilizes a unique automated market maker (AMM) algorithm, specifically designed to accommodate the characteristics of stablecoins, which tend to have prices that are closely pegged to each other or to a stable reference value.

Blockchain and Consensus Mechanism

Unlike platforms that operate their own blockchains, Curve is built atop the Ethereum network, relying on Ethereum’s security model and consensus mechanism. Ethereum uses a Proof of Stake (PoS) consensus mechanism, particularly under its latest upgrade, Ethereum 2.0. This shift from the previous Proof of Work model significantly reduces the energy consumption of the network and aims to improve its scalability. Within this framework, Curve’s transactions and smart contracts are secured by the same decentralized network of validators that secure Ethereum, ensuring integrity and resistance against attacks.

Smart Contracts and Curve’s AMM Algorithm

Curve’s AMM is a critical component of its architecture. Traditional AMMs maintain liquidity pools of two or more tokens and determine prices based on the relative supply of those tokens in the pool, often leading to significant price slippage when large trades are made. Curve’s AMM, however, uses a different mathematical approach—the StableSwap invariant. This formula is optimized for assets like stablecoins whose values are meant to be equivalent. It offers extremely low slippage and minimal deviation from the mean price, even during large trades, by using a dynamic adjustment system that reduces the curvature of the price function as liquidity increases.

Technological Distinctions from Other Projects

What sets Curve apart from other DeFi platforms is its focus on stablecoins and its efficiency in handling trades between assets of similar values. While many AMMs suffer from high slippage and impermanent loss, especially with volatile cryptocurrencies, Curve mitigates these issues through its specialized algorithm. Additionally, Curve has expanded its functionality to include various types of digital assets, including wrapped tokens, synthetics, and cryptocurrencies from other blockchains, facilitated by cross-chain compatibility.

The integration with multiple blockchains, such as Ethereum, Polygon, and Fantom, through various interoperability protocols, highlights Curve’s commitment to being a multi-chain platform. This ensures that users can benefit from Curve’s efficient trading mechanisms across different networks, taking advantage of faster transactions or lower fees, depending on their needs.

Tokenomics of Curve

The Curve DAO Token (CRV) is fundamentally a governance token within the Curve ecosystem, crucial for maintaining and developing the platform’s decentralized model. As a token, rather than a coin, CRV operates on the Ethereum blockchain as an ERC-20 token, which means it does not have its own blockchain but leverages Ethereum’s technology and security.

Emission Model and Distribution

CRV’s emission model is designed to encourage long-term participation and investment in the ecosystem. The total supply of CRV is capped at 3.03 billion tokens, with a gradual distribution model that extends over 6 years. The initial inflation rate was set high at approximately 2% per year but is designed to decrease over time, reducing the rate of new token issuance to create a deflationary pressure and potentially increase the token value as demand grows.

A significant portion of CRV tokens is allocated to liquidity providers who stake their tokens in liquidity pools. These participants are rewarded with a share of the trading fees generated by the platform, in addition to CRV tokens, which are distributed daily. This mechanism not only incentivizes liquidity but also secures it, ensuring that there is always enough liquidity available to facilitate trades with minimal slippage.

Governance and Staking

Holders of CRV tokens have governance rights, which include voting on various proposals that range from changes in fee structures to strategic updates and partnerships. This decentralized governance model is pivotal for the adaptability and community-driven evolution of the Curve platform.

Staking CRV also plays a dual role; it provides stakers with a direct governance ability while aligning their interests with the long-term success of the platform. Stakers can lock their CRV tokens for varying periods, with longer lock times providing greater governance power and a higher proportion of the network fees.

Price Dynamics

The price of CRV, like most cryptocurrencies, is influenced by market dynamics such as supply and demand, overall market sentiment, and macroeconomic factors affecting the broader crypto market. Since its launch, CRV has experienced volatility, common among DeFi tokens, reflecting both the rapid growth phases and market corrections typical of emerging financial technologies.

Where to Buy the CRV Token?

CRV tokens can be purchased on several prominent cryptocurrency exchanges, each offering various features tailored to different types of traders and investors. Some of the key platforms where CRV is available include:

- Binance: Known for its high liquidity and extensive range of trading pairs, Binance allows users to trade CRV against other cryptocurrencies, stablecoins, and fiat currencies.

- HTX (formerly Huobi): HTX offers a robust trading platform with a wide selection of cryptocurrency assets, including CRV, providing users with both spot and futures trading options.

- MEXC Global: This exchange is recognized for its user-friendly interface and a variety of trading options, making it a suitable choice for both beginners and experienced traders looking to acquire CRV.

- Bybit: Focused on derivatives and spot trading, Bybit provides a modern trading environment where users can trade CRV in different market conditions.

- KuCoin: Offers a wide range of cryptocurrencies, including CRV, and is known for its easy-to-use platform and competitive trading fees.

- Bitfinex: Catering more to professional traders, Bitfinex offers advanced trading features and high liquidity for trading CRV.

Each of these exchanges provides different interfaces, fee structures, and trading options, making it important for users to choose an exchange that best fits their trading needs and experience levels.

Where to Store the CRV Token?

When it comes to storing CRV, users have a variety of wallet options, ranging from hardware wallets to software wallets. Here are some recommended storage solutions:

- Hardware Wallets (Cold Storage): Ledger Nano X and Nano S: These hardware wallets offer robust security by storing tokens offline, making them inaccessible to online threats. Both support Ethereum-based tokens like CRV and allow users to manage their tokens with Ledger Live. Trezor Model T: Another secure hardware wallet that supports multiple cryptocurrencies including CRV. It features a touchscreen interface for enhanced usability.

- Software Wallets (Hot Wallets): MetaMask: A popular browser extension and mobile app that supports ERC-20 tokens like CRV. MetaMask is widely used for interacting with DeFi platforms directly from the wallet. Trust Wallet: A mobile wallet that offers support for multiple cryptocurrencies, including CRV. Trust Wallet also allows users to interact with DeFi applications seamlessly.

- MyEtherWallet (MEW): An open-source wallet that can be used through a web interface or paired with a hardware wallet for enhanced security. MEW supports all ERC-20 tokens and provides a direct gateway to the Ethereum blockchain.

For those actively trading or frequently using CRV in various DeFi protocols, keeping a portion of holdings in a software wallet like MetaMask or Trust Wallet might be practical for ease of use. However, for long-term storage, hardware wallets such as Ledger or Trezor provide an extra layer of security by keeping tokens offline and away from potential online vulnerabilities.

Project Prospects and Development Forecast

The growth potential of Curve is anchored in its specialized focus on stablecoin markets, which are increasingly relevant in both retail and institutional sectors of finance. Curve’s efficient and low-slippage transaction capabilities make it an attractive platform for a broad spectrum of users, including:

- Arbitrageurs: Who benefit from the small price discrepancies across different exchanges.

- Traders: Looking for quick and inexpensive ways to swap large amounts of stablecoins.

- Liquidity Providers: Who seek to earn fees and rewards by supplying stablecoins to the platform’s pools.

Key Partnerships and Collaborations

Curve has established a number of strategic partnerships that enhance its utility and integration across the DeFi ecosystem:

- Yearn.finance: Integrates with Curve to optimize yield farming strategies and enhance returns for liquidity providers.

- Convex Finance: Provides boosted CRV rewards and simplifies the staking process for Curve liquidity providers, thereby enhancing the incentives to supply liquidity to Curve pools.

- Chainlink: Utilizes Chainlink’s price feeds for accurate and tamper-proof market data, which is crucial for maintaining stable trading mechanisms.

- RenVM: Partners with Curve to facilitate cross-chain liquidity transfers, expanding the accessibility of Curve’s services across different blockchains.

These partnerships not only expand Curve’s operational capabilities but also bring in a diverse user base from various sectors of the cryptocurrency market, supporting sustained growth and development.

Development Forecast

Looking ahead, Curve’s development is expected to focus on further multi-chain integration, enhancing interoperability with other blockchains. This strategy will likely increase the platform’s user base and volume, as it allows Curve to tap into emerging markets and new liquidity pools. Additionally, ongoing improvements in Curve’s governance model and tokenomics are anticipated to further decentralize the project and enhance token holder engagement, which is crucial for maintaining a resilient and adaptable DeFi platform.

The Curve Ecosystem

The Curve ecosystem comprises various components that together create a comprehensive DeFi solution:

- Curve Pools: Various liquidity pools that allow for low slippage swaps between similar value assets.

- Curve DAO: A decentralized autonomous organization that governs the protocol and uses CRV tokens for governance decisions.

- Curve.fi: The primary interface for interacting with Curve pools and staking options.

- veCRV: Represents voting-escrowed CRV, providing users with governance power and increased staking rewards.

- Curve Wars: A competitive aspect involving DeFi platforms that incentivize liquidity provision to Curve pools through their respective tokens.

The ecosystem is designed to be self-sustaining with incentives aligned across different stakeholders, ensuring the long-term viability and relevance of the Curve platform within the DeFi landscape. As Curve continues to innovate and integrate with new technologies and platforms, it remains well-positioned to capitalize on the growing demand for efficient, decentralized financial services.

Conclusion

Curve’s strategic focus on stablecoin liquidity and its innovative use of AMM technology for minimal slippage transactions places it at the forefront of the DeFi movement. As blockchain technology progresses and the demand for more efficient financial solutions increases, Curve is likely to remain a key player, offering valuable services to advanced users and investors in the cryptocurrency space.