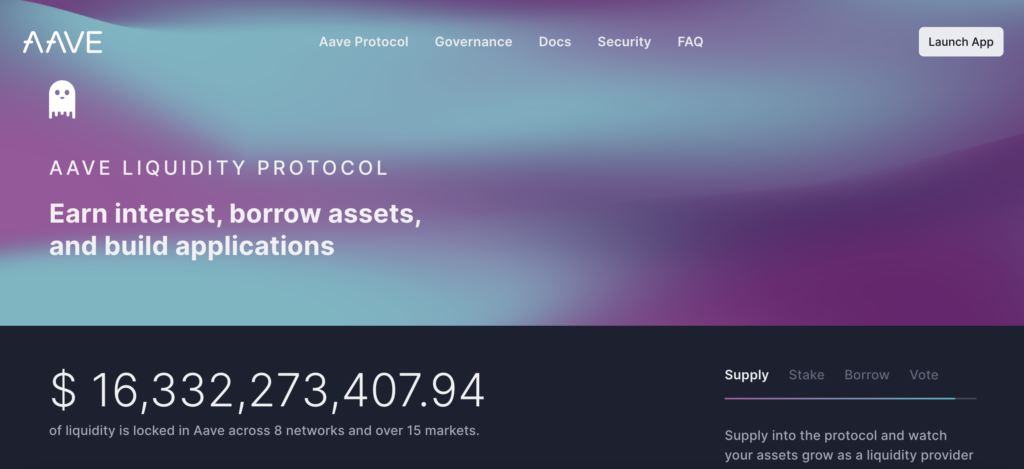

Aave is a decentralized finance protocol that enables users to lend and borrow cryptocurrencies without an intermediary. The project has been distinguished by its innovative approach to the DeFi sector, focusing on the creation of a fully decentralized and secure platform where users can interact with crypto assets through smart contracts.

History of the Project

Founded by Stani Kulechov in 2017, Aave started as ETHLend, a platform focused on lending Ethereum tokens. The project was rebranded to Aave, which means “ghost” in Finnish, in 2018 to reflect its broader vision of creating a transparent and open infrastructure for decentralized finance. This rebranding was accompanied by the introduction of several innovative features like flash loans and a variety of interest rate models. Aave’s development has been guided by robust community governance and contributions from a diverse team of blockchain experts, further establishing its foothold in the DeFi space.

What is Aave?

Aave is a protocol on Ethereum’s blockchain that facilitates the creation of money markets. Users can lend their cryptocurrencies and earn interest or borrow against collateral. Aave resolves the issue of liquidity in financial markets by providing a decentralized platform where users can access funds without traditional credit checks, utilizing blockchain technology to ensure security and transparency.

How the Aave Project Works

Aave is built on the Ethereum blockchain, utilizing its robust and secure infrastructure to implement a range of DeFi services. The technological distinctiveness of Aave stems from its innovative use of smart contracts and unique features that enhance its functionality and user experience.

Blockchain and Consensus Mechanism

Aave operates atop the Ethereum blockchain, which has transitioned from a Proof of Work (PoW) to a Proof of Stake (PoS) consensus mechanism through its significant upgrade known as Ethereum 2.0. This shift influences Aave’s operation by enhancing the underlying infrastructure that supports it.

With Ethereum’s move to PoS, the blockchain utilizes a staking mechanism for transaction verification and network security, replacing the computationally intensive mining used in PoW. In PoS, validators stake their ETH to be selected to validate blocks of transactions. This method not only reduces the environmental impact but also increases transaction throughput and lowers transaction fees, which are critical for DeFi applications like Aave.

Smart Contracts

The core operation of Aave revolves around smart contracts that automate the lending and borrowing processes. These contracts are programmed to manage the liquidity pools where users deposit their assets to earn interest or borrow by providing collateral. The protocol’s smart contracts automatically handle the distribution of interest rates based on the algorithmic calculation of supply and demand dynamics for different cryptocurrencies.

Unique Technological Features

Aave distinguishes itself with several key technological innovations:

- Flash Loans: These are a novel feature not widely available in other DeFi platforms. Flash loans allow users to borrow assets without collateral, with the stipulation that the loan must be returned within the same transaction block. If the loan is not repaid, the transaction is reversed, ensuring the safety of the funds in the liquidity pool. This feature enables a variety of financial maneuvers, such as arbitrage, collateral swapping, or self-liquidation.

- Rate Switching: Aave offers users the ability to switch between fixed and variable interest rates. This is particularly useful in managing borrow costs predictably amidst the highly volatile interest rates commonly seen in DeFi markets.

- Decentralized Governance: The AAVE token not only serves as a governance token but also integrates staking mechanisms that allow token holders to secure the network. Stakers in the Aave protocol can participate in the decision-making process and vote on crucial proposals, including those concerning upgrades and protocol adjustments.

Role of Technologies in Aave’s Operations

The integration of these technologies enables Aave to offer a flexible and secure platform for decentralized finance. Ethereum’s blockchain provides a tried-and-tested foundation for deploying Aave’s smart contracts, which are essential for the trustless executing of transactions within the protocol. Smart contracts automate complex processes and ensure that all transactions within Aave are transparent and immutable.

Tokenomics of Aave

Aave utilizes a utility and governance token named AAVE. This is a token, not a coin, because it operates on top of the Ethereum blockchain rather than having its own independent blockchain.

Token Classification and Utility

AAVE tokens serve multiple key roles within the Aave ecosystem. Primarily, they are used for governance, allowing token holders to vote on decisions that affect the direction and operation of the protocol. Additionally, AAVE can be staked in the protocol’s Safety Module, providing security and insurance to the network in exchange for staking rewards.

Emission Model and Distribution

AAVE has a capped supply of 16 million tokens, out of which 13 million were converted from the original LEND tokens at a rate of 100 LEND per 1 AAVE during the migration to the new model in October 2020. The remaining 3 million tokens are allocated to the Aave Ecosystem Reserve to fund project development, adoption, and community initiatives.

Token Value and Market Behavior

The value of AAVE, like most cryptocurrencies, is influenced by market dynamics such as supply and demand, overall crypto market trends, and investor sentiment. However, specific events such as protocol upgrades, enhancements, and governance decisions can also significantly impact its price. AAVE’s value is also bolstered by its deflationary aspects; the protocol periodically buys back tokens from the market using protocol fees, which are then burnt to reduce the overall token supply.

Governance and Staking

The governance mechanism in Aave is a crucial aspect of its tokenomics. AAVE token holders can propose and vote on Aave Improvement Proposals (AIPs), which govern changes to the protocol. This model encourages active community participation and aligns the interests of stakeholders with the long-term health of the protocol.

Staking AAVE in the Safety Module helps to secure the protocol by acting as a mitigation mechanism against shortfall events. In return for locking their tokens, stakers receive safety incentives, which are distributed in AAVE, further aligning network security with token holder interests.

The AAVE token’s utility in governance, staking, and the protocol’s deflationary strategies are all designed to support both the stability of the Aave platform and the economic interests of its users, contributing to a robust and sustainable tokenomics structure.

Where to Buy AAVE Tokens

AAVE tokens are available on several leading cryptocurrency exchanges, offering multiple options for potential investors or users to acquire the tokens easily. Key exchanges include:

- Binance: Offers trading pairs for AAVE with major cryptocurrencies and stablecoins, providing a robust trading platform with high liquidity.

- HTX (formerly Huobi): Known for its secure trading environment, HTX lists AAVE and supports both spot and futures trading.

- MEXC: Features a wide range of crypto assets including AAVE, catering to a global audience with efficient trading tools.

- Bybit: This exchange provides options for spot and derivative trading in AAVE, attracting both regular traders and those looking for leverage options.

- KuCoin: Known for its user-friendly interface, KuCoin allows users to trade AAVE against various cryptocurrencies.

- Bitfinex: Offers advanced trading features and high liquidity for AAVE trading, suitable for both novice and experienced traders.

These platforms provide comprehensive services such as buying, selling, and trading AAVE, along with different financial instruments like futures and options where traders can speculate on the price movements of AAVE.

Where to Store AAVE Tokens

When it comes to storing AAVE tokens, users have several options, each offering different levels of security and functionality:

- Hardware Wallets (Cold Wallets): Devices like Ledger Nano S or Ledger Nano X and Trezor provide the highest level of security by storing tokens offline, thus protecting them from online hacks.

- Software Wallets (Hot Wallets): Wallets like MetaMask, Coinbase Wallet, and Trust Wallet allow for easy access and management of AAVE tokens directly through a smartphone or web browser. These are more convenient for regular transactions.

- Web Wallets: Platforms like MyEtherWallet offer web-based solutions that can interact with hardware wallets, combining ease of use with increased security.

For maximum security, hardware wallets are recommended, especially for storing large amounts of AAVE or for long-term holdings. Software wallets offer more convenience and faster access, making them suitable for everyday use and trading activities.

Future Prospects and Development Forecast

Aave’s growth is primarily fueled by its strong position in the decentralized finance (DeFi) sector, continuous technological innovation, and expansive partnership network. As the DeFi space evolves, Aave remains at the forefront by consistently upgrading its offerings and expanding its market reach.

Growth Drivers

The growth of Aave is driven by several key factors:

- Technological Innovation: Aave continues to pioneer new features like flash loans and improvements in smart contract designs, which enhance transaction security and efficiency.

- Expanding User Base: As awareness of DeFi increases, more users are drawn to Aave’s platform due to its user-friendly interface and robust feature set.

- Strategic Partnerships: Collaborations with other blockchain projects and integration into various ecosystems help expand Aave’s utility and accessibility.

Key Clients and Partners

Aave’s clientele ranges from individual DeFi enthusiasts and traders to institutional investors interested in decentralized lending and borrowing markets. Some of its notable partnerships include:

- Chainlink: Integrates with Aave for secure and reliable price feeds, which are crucial for maintaining the stability of the lending and borrowing mechanisms.

- RealT: Allows for tokenized real estate loans on Aave, broadening the scope of assets available for lending.

- Polygon (MATIC): Collaboration to scale Aave’s transactions and reduce gas fees, making the platform more accessible and efficient for users.

Development Forecast

The future development of Aave looks promising with plans to expand further into the DeFi ecosystem, potentially incorporating undercollateralized loan options and more real-world assets into its lending markets. Continuous improvement of the platform’s scalability and interoperability with other blockchains could also enhance Aave’s adoption among a broader audience.

Aave’s Ecosystem

The Aave ecosystem comprises a robust network of services and integrations that support its core functionalities:

- Aave Protocol: The foundational layer where all lending and borrowing activities occur.

- Staking and Safety Module: Provides security to the protocol while allowing AAVE holders to earn rewards.

- Governance Framework: Allows AAVE holders to participate in decision-making processes that guide the evolution of the platform.

- Aavegotchi: A decentralized finance game that combines elements of DeFi with non-fungible tokens (NFTs), increasing engagement within the Aave ecosystem.

This ecosystem not only enhances user experience and engagement but also fosters a versatile environment conducive to financial innovation and security in the DeFi space. As Aave continues to build and strengthen these components, it remains well-positioned to adapt to and shape future trends in decentralized finance.

Conclusion

Aave remains at the forefront of the DeFi movement, driven by a combination of robust technology, a proactive community, and continuous innovation. Its commitment to decentralization and transparency sets a benchmark in the sector. For advanced users and investors looking to understand the strategic potential of DeFi projects, Aave represents a compelling case study with a solid foundation and a promising trajectory for future growth and integration within the broader financial landscape.