In this article, we will explore the Request project and its native cryptocurrency, REQ. The Request project aims to revolutionize the way financial transactions and invoicing are conducted on the blockchain. As we delve into the various aspects of the project, we will provide a comprehensive analysis of its history, technological infrastructure, tokenomics, ecosystem, growth prospects, and future outlook. This detailed examination will help you understand the unique value proposition of Request and how it stands out in the rapidly evolving landscape of blockchain technology and digital finance.

What is Request Network?

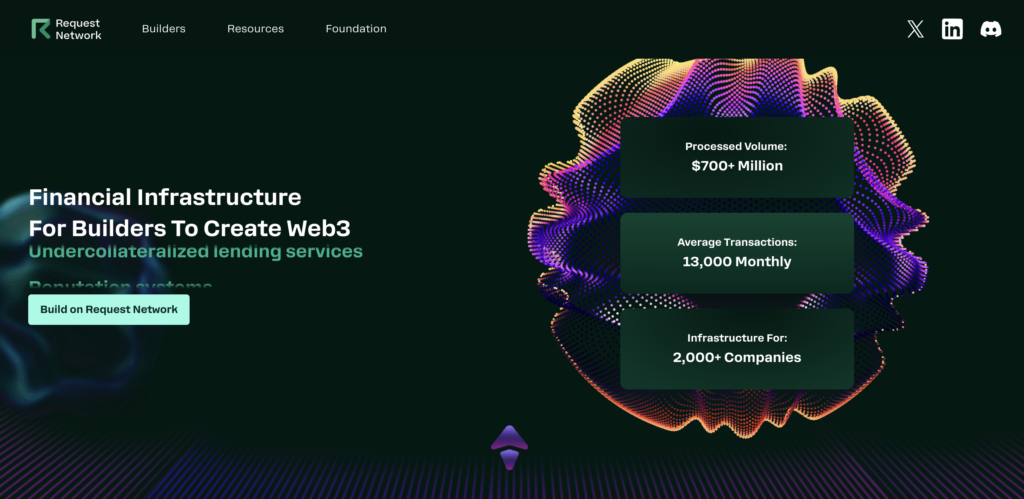

Request Network is a decentralized protocol built on the Ethereum blockchain designed to simplify and secure the process of creating and managing financial transactions and invoices. The core objective of Request is to enable anyone to create, share, and fulfill payment requests without the need for intermediaries. This not only reduces transaction fees but also enhances transparency and security. By leveraging smart contracts, Request ensures that all transaction details are immutable and verifiable, promoting trust and efficiency in financial dealings. The protocol supports various currencies and can be integrated with multiple financial services, providing a versatile solution for both individuals and businesses.

Project History

Request Network was founded in 2017 with the goal of transforming the way financial transactions are handled on the blockchain. Since its inception, the project has achieved several significant milestones:

- 2017: Launch of the Request whitepaper and initial development phase.

- 2018: Introduction of the mainnet, allowing users to start creating and managing payment requests on the Ethereum blockchain.

- 2019: Expansion of features including support for various fiat and cryptocurrencies, enhancing the protocol’s versatility.

- 2020: Integration with major DeFi platforms and improvement of interoperability with other blockchain ecosystems.

- 2021: Focus on enhancing user experience and scaling solutions to accommodate a growing number of users and transactions.

- 2022: Development of advanced invoicing and auditing features to cater to enterprise needs.

- 2023: Continuous improvement of the protocol’s security and performance, along with strategic partnerships to expand its ecosystem.

Throughout its development, Request Network has remained committed to providing a decentralized, efficient, and secure platform for financial transactions and invoicing, continually adapting to the needs of the blockchain community and the broader financial industry.

How Request Network Works

Request Network operates on a decentralized protocol built atop the Ethereum blockchain, utilizing a range of advanced technologies to facilitate secure and transparent financial transactions. At its core, Request leverages smart contracts to automate and enforce the terms of payment requests, ensuring accuracy and immutability of transaction data.

Key Technologies and Their Roles

Smart Contracts: Smart contracts are self-executing contracts with the terms of the agreement directly written into code. In Request Network, they play a crucial role by automating the process of payment requests, from creation to fulfillment, without requiring intermediaries. This reduces costs and enhances security by eliminating the risk of manual errors or tampering.

Interoperability: Request Network supports multiple currencies, including both fiat and cryptocurrencies, through various integrations. This flexibility allows users to create and settle invoices in their preferred currency, making the platform versatile and widely applicable.

Decentralized Identity: The platform incorporates decentralized identity solutions to ensure that all participants can verify each other’s credentials securely. This adds an additional layer of trust and security to the transactions.

Data Privacy: Request uses advanced encryption techniques to protect the privacy of transactional data while still maintaining the transparency and traceability inherent to blockchain technology.

Blockchain and Consensus Mechanism

Request Network is built on the Ethereum blockchain, utilizing its robust infrastructure to ensure the security and decentralization of transactions. Ethereum employs a Proof of Stake (PoS) consensus mechanism, particularly after its transition from Proof of Work (PoW) through the Ethereum 2.0 upgrade.

Proof of Stake (PoS): In PoS, validators are chosen to create new blocks and confirm transactions based on the number of tokens they hold and are willing to “stake” as collateral. This mechanism is more energy-efficient compared to PoW, as it doesn’t require extensive computational power. PoS enhances security by making it economically impractical for validators to act maliciously since they risk losing their staked assets.

Technical Details:

- Ethereum Virtual Machine (EVM): Request smart contracts run on the EVM, which executes contract code and ensures that transactions are processed consistently across all nodes in the network.

- Layer 2 Solutions: To address scalability concerns, Request Network integrates Layer 2 scaling solutions like rollups, which bundle multiple transactions into a single batch processed off-chain before being recorded on the main Ethereum chain. This reduces congestion and lowers transaction fees.

Distinctive Features

Request Network distinguishes itself from other blockchain-based financial solutions through its focus on comprehensive financial request management. Unlike many DeFi platforms that primarily offer lending, borrowing, or trading services, Request provides a holistic invoicing and payment request system. This specialization allows it to cater to both individual users and enterprises, offering tools that are specifically designed to streamline financial operations, from simple peer-to-peer payments to complex corporate invoicing processes.

Tokenomics of Request Network

The native digital asset of the Request Network is the REQ token, which functions as a utility token within the ecosystem. Unlike coins, which typically operate on their own blockchains, REQ is an ERC-20 token built on the Ethereum blockchain, leveraging Ethereum’s robust security and infrastructure.

Utility and Functionality

REQ tokens serve several essential purposes within the Request Network:

- Payment for Services: Users pay REQ tokens as fees for creating and managing payment requests and invoices on the network. This ensures a consistent demand for the token.

- Staking and Governance: Token holders can stake their REQ tokens to participate in the governance of the network, contributing to decisions on upgrades, changes to the protocol, and other community-driven initiatives.

- Incentives: REQ tokens are used to incentivize developers to build and integrate additional features and services into the Request ecosystem, fostering continuous growth and innovation.

Emission Model

The total supply of REQ tokens was fixed during its initial coin offering (ICO), with no new tokens created thereafter. This capped supply model is designed to prevent inflation and maintain the token’s value over time.

- Total Supply: 1,000,000,000 REQ

- Circulating Supply: Approximately 999,830,000 REQ (subject to periodic updates based on token burns and usage)

Token Burn Mechanism

A unique aspect of REQ tokenomics is its deflationary model, where a portion of the tokens used for fees is burned, permanently removing them from circulation. This mechanism helps increase the scarcity of the token, potentially enhancing its value over time.

Price and Market Performance

The price of REQ tokens fluctuates based on market conditions, demand for services on the Request Network, and overall sentiment in the cryptocurrency market. Historically, REQ has experienced significant price movements, reflective of the broader market trends and the project’s milestones.

| Year | Price (USD) | Market Cap (USD) |

|---|---|---|

| 2017 | $0.05 | $50,000,000 |

| 2018 | $0.30 | $300,000,000 |

| 2019 | $0.02 | $20,000,000 |

| 2020 | $0.10 | $100,000,000 |

| 2021 | $0.25 | $250,000,000 |

| 2022 | $0.05 | $50,000,000 |

| 2023 | $0.15 | $150,000,000 |

The table above illustrates the historical price and market cap data, demonstrating the token’s volatility and growth potential.

Economic Model

REQ’s economic model is designed to balance utility with scarcity. By requiring tokens for service fees and governance participation, it ensures constant utility-driven demand. The burn mechanism further complements this by reducing the supply, creating a dynamic where increased network usage can lead to higher token value over time. This dual approach aims to support both the operational needs of the Request Network and the investment interests of token holders.

Where to Buy REQ Token

REQ tokens can be purchased on several major cryptocurrency exchanges. Here is a list of prominent platforms where REQ is traded:

- Binance: One of the largest and most popular cryptocurrency exchanges globally, offering a wide range of trading pairs and high liquidity for REQ tokens.

- HTX (formerly Huobi): A major exchange known for its comprehensive trading options and user-friendly interface, providing ample liquidity and various trading pairs for REQ.

- Gate.io: A rapidly growing exchange that offers a diverse set of cryptocurrencies, including REQ, with competitive trading fees and features.

- BingX: A well-known exchange particularly popular for its derivatives trading, but also supports spot trading for tokens like REQ.

- KuCoin: Known for its extensive list of supported cryptocurrencies, KuCoin provides a robust platform for trading REQ with multiple trading pairs and liquidity options.

To purchase REQ, users need to create an account on one of these exchanges, complete the necessary verification processes, deposit funds (either fiat or cryptocurrency), and place an order for REQ tokens.

Where to Store REQ Token

Storing REQ tokens securely is crucial to protect your investment. Here are some recommended wallets for storing REQ:

- MetaMask: A widely used Ethereum wallet that supports all ERC-20 tokens, including REQ. It offers a browser extension and mobile app, making it convenient for daily use and interaction with decentralized applications (dApps).

- Ledger Nano S/X: Hardware wallets that provide an extra layer of security by storing your private keys offline. These devices support REQ tokens and other ERC-20 tokens, ensuring your assets are protected from online threats.

- Trezor: Another hardware wallet option known for its robust security features. Trezor wallets support REQ tokens and provide a secure environment for managing your assets.

- Trust Wallet: A mobile wallet that supports a wide range of cryptocurrencies, including REQ. Trust Wallet is user-friendly and integrates seamlessly with decentralized exchanges and other dApps.

- MyEtherWallet (MEW): A web-based wallet that allows users to store and manage ERC-20 tokens like REQ. MEW provides a secure interface for interacting with the Ethereum blockchain and supports hardware wallet integrations for added security.

By choosing a reputable wallet that fits your security needs and usage preferences, you can ensure that your REQ tokens are stored safely and are readily accessible for transactions and other activities within the Request ecosystem.

Project Prospects

Basis for Growth

The growth of Request Network is grounded in its ability to provide decentralized, efficient, and secure financial transaction and invoicing solutions. Key factors contributing to its growth include:

- Adoption of Blockchain Technology: As more businesses and individuals recognize the benefits of blockchain technology, the demand for decentralized financial solutions like those offered by Request Network is expected to increase.

- Scalability and Interoperability: Continuous improvements in scalability through Layer 2 solutions and interoperability with other blockchains enhance the network’s capacity to handle growing transaction volumes and integrate with diverse financial systems.

- Regulatory Compliance: By focusing on compliance with global financial regulations, Request Network positions itself as a reliable solution for enterprises looking to adopt blockchain technology within legal frameworks.

Clients and Partners

Request Network serves a diverse range of clients, from individual users to large enterprises. Its partners play a significant role in expanding its ecosystem and enhancing its functionalities. Notable clients and partners include:

- PwC: Collaborating on blockchain-based invoicing and payment solutions.

- MakerDAO: Integrating Dai stablecoin for seamless transactions within the Request ecosystem.

- Kyber Network: Providing liquidity solutions for token swaps and payments.

- Aave: Integrating lending and borrowing services to enhance financial functionalities.

- Gnosis: Partnering on decentralized finance (DeFi) initiatives and tools.

Development Forecast

The future development of Request Network is poised to focus on several strategic areas:

- Enterprise Adoption: Increasing efforts to attract large enterprises by offering tailored solutions for complex invoicing and financial management needs.

- Enhanced User Experience: Ongoing improvements to the platform’s usability and accessibility to ensure it meets the needs of both novice users and experienced professionals.

- DeFi Integration: Deepening integration with DeFi protocols to expand the range of financial services available within the Request ecosystem.

- Geographic Expansion: Expanding its reach into new markets, particularly in regions with high growth potential for blockchain adoption.

Ecosystem

The Request Network ecosystem comprises various components and integrations that enhance its functionality and usability. The ecosystem includes:

- Payment Gateways: Integration with popular payment gateways to facilitate easy conversion between fiat and cryptocurrencies.

- Decentralized Applications (dApps): Support for a variety of dApps that leverage Request Network’s invoicing and payment capabilities.

- Stablecoins: Incorporation of stablecoins like Dai and USDC to provide stable transaction options within the ecosystem.

- Wallet Integrations: Compatibility with major wallets like MetaMask, Ledger, and Trust Wallet to ensure secure storage and easy access to REQ tokens.

- Developer Tools: Provision of comprehensive SDKs and APIs to encourage developers to build on top of the Request Network, fostering innovation and growth.

By continually expanding its ecosystem and forging strategic partnerships, Request Network aims to solidify its position as a leading provider of decentralized financial solutions, driving sustained growth and adoption in the blockchain space.

Conclusion

The Request project represents a significant innovation in the realm of blockchain-based financial solutions. By providing a detailed exploration of its various components, we have highlighted the project’s potential impact on the industry and its future growth trajectory. Through continuous development and adoption, Request aims to redefine the standards of financial transactions and decentralized invoicing on a global scale.