In the evolving landscape of blockchain technology, Polymath stands out as a unique project focused on the niche of tokenized securities. This article provides a comprehensive analysis of Polymath and its native cryptocurrency, POLY. We will explore the various dimensions of Polymath, including its ecosystem, technological underpinnings, tokenomics, and future growth prospects. By delving into these aspects, we aim to offer a thorough understanding of how Polymath is shaping the future of financial securities through blockchain technology.

What is Polymath?

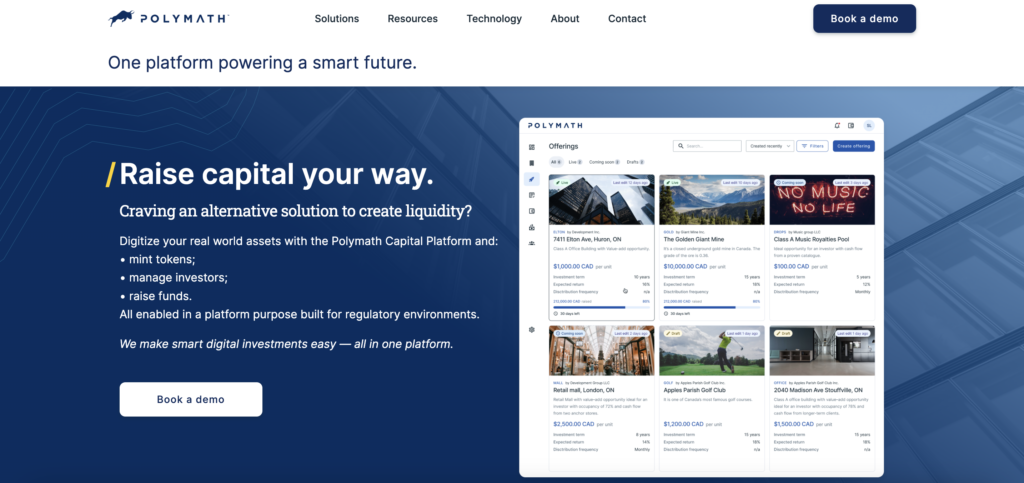

Polymath is a blockchain-based platform designed to facilitate the creation, issuance, and management of security tokens. By leveraging blockchain technology, Polymath aims to streamline the process of tokenizing traditional financial securities, such as stocks, bonds, and real estate. The platform provides a comprehensive framework that addresses the regulatory and compliance requirements necessary for security token offerings (STOs). Polymath’s infrastructure includes a protocol layer that ensures security tokens are compliant with relevant regulations and a suite of tools that assist issuers throughout the token lifecycle. By doing so, Polymath solves the complexities and inefficiencies associated with the traditional securities market, offering a more efficient, transparent, and accessible solution.

History of Polymath

Polymath was founded in 2017 with the vision of democratizing access to financial securities through blockchain technology. Since its inception, the project has achieved several key milestones:

- 2017: Polymath was established and began developing its protocol to enable the creation and management of security tokens.

- 2018: The platform launched its testnet, allowing users to explore its capabilities and functionalities. During the same year, Polymath conducted its Initial Coin Offering (ICO), distributing the native POLY token.

- 2019: Polymath released its mainnet, enabling the first security tokens to be issued on its platform. This marked a significant step towards realizing the project’s vision of tokenizing traditional financial assets.

- 2020: The project introduced Polymesh, a purpose-built blockchain specifically designed for security tokens, enhancing the compliance and security features of the platform.

- 2021: Polymath transitioned to the Polymesh blockchain, further solidifying its commitment to providing a robust and regulatory-compliant infrastructure for security tokens.

Throughout its development, Polymath has continued to innovate and expand its ecosystem, establishing partnerships and collaborations to enhance its offerings and support the growth of the security token market.

How Polymath Works

Polymath operates on a sophisticated technological infrastructure designed to streamline the issuance and management of security tokens. Central to its functionality is the Polymesh blockchain, a bespoke blockchain created specifically for security tokens. Polymesh is engineered to address the unique regulatory and compliance challenges associated with securities, ensuring that tokenized assets remain compliant throughout their lifecycle.

Polymesh Blockchain

Polymesh distinguishes itself from other blockchains by focusing on regulatory compliance and security. Unlike general-purpose blockchains, Polymesh is purpose-built for security tokens, integrating compliance directly into the protocol layer. This integration is facilitated through several key components:

- Identity Verification: Polymesh requires all participants to undergo a comprehensive identity verification process, ensuring that only verified entities can issue, manage, or trade security tokens. This compliance measure aligns with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

- On-Chain Governance: Polymesh incorporates a governance framework that allows stakeholders to participate in decision-making processes. This framework ensures that changes to the protocol or network rules are conducted transparently and democratically, enhancing the trust and reliability of the ecosystem.

- Compliance Engine: At the core of Polymesh is its compliance engine, which enforces regulatory requirements and transaction rules. This engine ensures that security tokens can only be transferred to eligible and verified participants, preventing unauthorized transactions and maintaining regulatory adherence.

Consensus Mechanism

Polymesh utilizes a unique consensus mechanism known as Nominated Proof of Stake (NPoS). NPoS is designed to enhance security and decentralization while ensuring high throughput and low latency, which are crucial for financial transactions. In this mechanism:

- Validators: Validators are responsible for producing new blocks and validating transactions. They are selected based on their reputation, technical capabilities, and the amount of POLY tokens staked by nominators.

- Nominators: Nominators support the network by staking their POLY tokens in favor of trusted validators. In return, they receive a portion of the rewards generated by the validators they support.

- Staking and Rewards: Both validators and nominators earn rewards for their participation, incentivizing active involvement in maintaining the network’s integrity and performance.

Technical Details

Polymesh employs advanced cryptographic techniques and smart contract functionality to ensure the secure and efficient operation of its blockchain. The network supports smart contracts that automate compliance processes and facilitate complex financial transactions. Additionally, Polymesh utilizes:

- Zero-Knowledge Proofs: These are used to enhance privacy and security by allowing the verification of transactions without revealing sensitive information.

- Multi-Signature Wallets: These wallets require multiple signatures to authorize transactions, adding an extra layer of security for asset management.

By integrating these technologies, Polymath offers a robust and compliant infrastructure for the tokenization of securities, setting it apart from other blockchain projects focused on general asset tokenization.

Tokenomics of Polymath

Polymath’s native asset, POLY, is a token rather than a coin. This distinction is important as POLY operates on an existing blockchain rather than its own standalone blockchain network. POLY is essential to the Polymath ecosystem, serving multiple functions that facilitate the platform’s operations and incentivize participation.

Emission Model and Supply

POLY has a fixed total supply of 1 billion tokens, which were pre-minted during its Initial Coin Offering (ICO) in 2018. The distribution of POLY tokens was designed to ensure wide participation and to incentivize the development and adoption of the Polymath platform. The allocation of POLY tokens is as follows:

| Category | Allocation |

|---|---|

| ICO Participants | 50% |

| Team and Advisors | 25% |

| Reserve Fund | 15% |

| Marketing and Partnerships | 10% |

Token Utility

POLY tokens are integral to the functioning of the Polymath platform. They are used to:

- Pay Fees: Issuers use POLY tokens to pay for the creation, issuance, and management of security tokens on the Polymath platform. This includes regulatory compliance checks and identity verification services.

- Staking: Validators and nominators in the Polymesh blockchain stake POLY tokens to secure the network and validate transactions. Staking helps maintain network security and performance, with rewards distributed in POLY.

- Governance: POLY holders can participate in the on-chain governance processes, influencing decisions regarding protocol updates and network improvements.

Price Dynamics

The price of POLY has experienced fluctuations typical of most cryptocurrencies. Key factors influencing its price include the overall adoption of the Polymath platform, developments in regulatory landscapes, and broader market trends in the cryptocurrency sector. As of the latest data, POLY’s price is influenced by its utility within the Polymath ecosystem, the success of security token offerings (STOs) on its platform, and market speculation.

Market Performance

Since its ICO, POLY has been traded on various cryptocurrency exchanges, with its price reflecting the market’s perception of Polymath’s progress and potential. The token has seen periods of significant appreciation during bullish market conditions and corrections during bearish phases.

Summary of Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 1,000,000,000 POLY |

| Circulating Supply | Varies with market dynamics |

| Emission Type | Fixed Supply |

| Primary Use Cases | Transaction fees, staking, governance |

| Influencing Factors | Platform adoption, regulatory developments, market trends |

Polymath’s tokenomics are structured to support the platform’s long-term growth and sustainability, ensuring that POLY remains a central component in the ecosystem’s functionality and governance.

Where to Store POLY Tokens

Storing POLY tokens securely is crucial for maintaining the safety of your assets. Here are the recommended wallets for storing POLY:

- Ledger Nano S/X: As hardware wallets, Ledger devices offer top-tier security for storing POLY. They keep your private keys offline, providing protection against online threats and hacking attempts.

- Trezor: Another hardware wallet, Trezor, supports POLY storage with robust security features and an easy-to-use interface for managing your assets.

- MyEtherWallet (MEW): This web-based wallet supports ERC-20 tokens like POLY. MEW allows you to interact directly with the Ethereum blockchain, offering features such as token transfers and smart contract interactions.

- MetaMask: A popular browser extension and mobile wallet, MetaMask supports POLY storage and provides seamless access to decentralized applications (dApps) on the Ethereum network.

- Trust Wallet: A mobile wallet that supports a wide range of cryptocurrencies, including POLY. Trust Wallet offers an intuitive interface and strong security features, making it suitable for storing and managing your POLY tokens.

Each of these wallets offers distinct features catering to different user preferences and security needs, ensuring that you can store your POLY tokens safely and efficiently.

Project Growth Prospects

Polymath’s growth is underpinned by its focus on regulatory-compliant security token offerings (STOs), a niche market within the broader blockchain ecosystem. As traditional financial institutions and asset issuers increasingly explore blockchain technology for tokenizing assets, Polymath’s comprehensive and compliant platform positions it advantageously. Key factors driving the project’s growth include:

- Regulatory Compliance: Polymath’s emphasis on adhering to regulatory standards appeals to institutional investors and traditional financial entities seeking to enter the digital asset space.

- Innovative Technology: The development of the Polymesh blockchain, specifically designed for security tokens, sets Polymath apart from other blockchain projects. Polymesh’s built-in compliance and identity verification features cater to the unique needs of the securities market.

- Market Adoption: The growing acceptance of security tokens as a viable financial instrument is driving demand for platforms like Polymath. As more assets are tokenized, Polymath’s user base is expected to expand significantly.

Clients and Partners

Polymath has established strategic partnerships and collaborations to enhance its platform and expand its reach. Key clients and partners include:

- Token Issuers: Companies and financial institutions looking to tokenize traditional assets such as equity, debt, and real estate.

- Service Providers: Firms offering KYC/AML compliance, legal, and financial advisory services that integrate with Polymath’s platform.

- Technology Partners: Collaborations with blockchain infrastructure providers and developers to continuously improve the Polymesh blockchain.

Growth Forecast

The forecast for Polymath’s development is promising, given the increasing interest in security tokenization. Key projections include:

- Increased Adoption: As regulatory clarity improves and more jurisdictions adopt favorable regulations for security tokens, Polymath is poised to attract more issuers and investors.

- Technological Advancements: Ongoing development and enhancements of the Polymesh blockchain will likely lead to greater scalability, security, and functionality, attracting a broader user base.

- Market Expansion: Expansion into new geographical markets and sectors beyond traditional finance, such as real estate and commodities, could drive further growth.

Project Ecosystem

Polymath’s ecosystem is a comprehensive network designed to support the entire lifecycle of security tokens. This ecosystem includes:

- Polymesh Blockchain: The dedicated blockchain for security tokens, providing compliance, identity verification, and on-chain governance.

- POLY Token: The native utility token used for transactions, staking, and governance within the Polymath ecosystem.

- Token Studio: A suite of tools and services for issuers to create, issue, and manage security tokens.

- Compliance Service Providers: Integrated services for KYC/AML checks, legal compliance, and regulatory reporting.

- Wallets and Custodians: Secure storage solutions for POLY and security tokens, ensuring the safekeeping of digital assets.

Key Components of the Ecosystem

- Token Issuance Platform: Enables issuers to create and manage compliant security tokens.

- Compliance Services: Partners providing regulatory compliance, KYC, and AML services.

- Investor Management: Tools for managing investor relations and communications.

- Exchange Integrations: Partnerships with exchanges for listing and trading security tokens.

Polymath’s ecosystem is designed to offer a seamless and secure environment for the creation and management of security tokens, fostering growth and adoption within the digital asset space.

Conclusion

As blockchain technology continues to revolutionize the financial industry, projects like Polymath play a crucial role in bridging the gap between traditional finance and the decentralized world. With a clear focus on regulatory compliance and security token offerings, Polymath is poised to be a significant player in the tokenization of assets. This analysis provides valuable insights into Polymath’s potential and the transformative impact it could have on the global financial ecosystem.