This article provides a comprehensive examination of the JUST project and its associated cryptocurrency, JST. We will explore the project’s history, technological structure, tokenomics, ecosystem, and potential growth prospects. By delving into these aspects, readers will gain a thorough understanding of how JUST operates within the blockchain and decentralized finance (DeFi) space, and what the future might hold for this innovative initiative.

What is JUST?

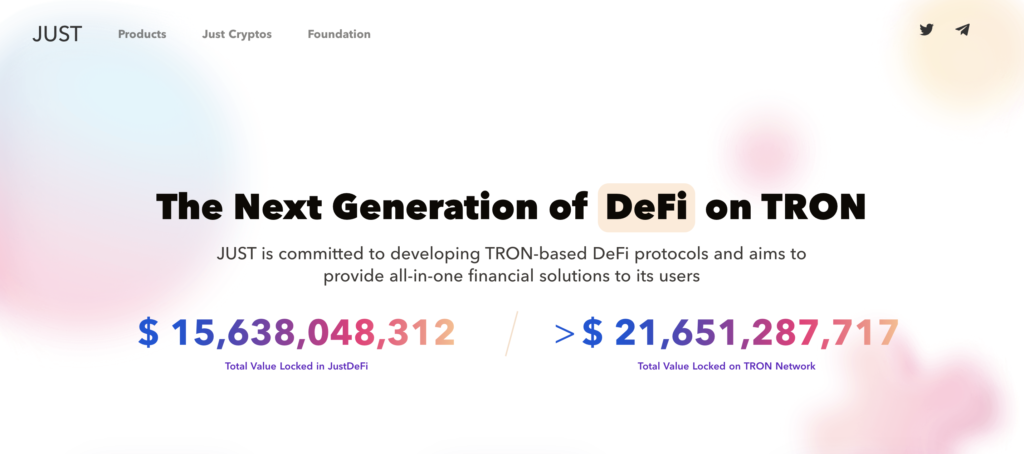

JUST is a comprehensive decentralized finance (DeFi) platform built on the TRON blockchain. It aims to provide a suite of financial products that cater to various aspects of DeFi, including stablecoin issuance, lending, and asset swapping. The platform’s core product, JustStable, is a multi-collateralized decentralized stablecoin system that issues USDJ, a stablecoin pegged to the US dollar. Additionally, JUST includes JustLend, a decentralized money market protocol, and JustSwap, an automated market maker (AMM) for token exchanges. The JUST ecosystem is designed to offer a complete DeFi experience by integrating these diverse functionalities into a cohesive platform.

Project History

The JUST project was announced and supported by the TRON Foundation, with its first public appearance linked to Poloniex’s LaunchBase platform. Key milestones in its development include:

- April 2020: JUST (JST) was introduced as the first project on Poloniex LaunchBase, where it conducted its initial token sale. This sale was notable for its rapid completion, with all tokens sold within minutes.

- May 2020: Trading for JST began on major exchanges such as Poloniex, marking the token’s entry into the broader cryptocurrency market.

- Subsequent Developments: The project quickly expanded its ecosystem to include multiple DeFi products. This includes JustStable for stablecoin issuance, JustLend for decentralized lending and borrowing, and JustSwap for automated token swaps. These products collectively enhance the utility and liquidity of the JST token within the TRON network.

Throughout its history, JUST has focused on leveraging the TRON blockchain’s capabilities to create a robust, scalable, and user-friendly DeFi platform. The project’s continuous evolution and integration of new financial products underscore its commitment to providing comprehensive DeFi solutions.

How JUST Works

JUST is a DeFi platform built on the TRON blockchain, utilizing a suite of technologies to provide decentralized financial services. The project operates primarily through its various sub-platforms: JustStable, JustLend, JustSwap, and JustLink. Each of these components leverages TRON’s blockchain infrastructure to offer unique financial functionalities.

Core Technologies

- JustStable: This platform issues the USDJ stablecoin, which is pegged to the US dollar. Users can mint USDJ by collateralizing TRX tokens. The stability of USDJ is maintained through smart contracts that manage collateral ratios and liquidation mechanisms.

- JustLend: A decentralized lending platform where users can lend and borrow assets with interest rates determined algorithmically based on supply and demand. Users can supply assets to earn interest or borrow assets by providing collateral.

- JustSwap: An automated market maker (AMM) that allows for decentralized token exchanges. It facilitates the creation of liquidity pools and enables users to trade TRC-20 tokens directly from their wallets.

- JustLink: A decentralized oracle system that provides smart contracts with access to real-world data, ensuring that the JUST ecosystem can interact with external information securely and reliably.

Blockchain and Consensus Mechanism

JUST is built on the TRON blockchain, which uses a Delegated Proof of Stake (DPoS) consensus mechanism. This system involves TRX holders voting for super representatives (SRs), who are responsible for validating transactions and securing the network.

- Delegated Proof of Stake (DPoS): Unlike Proof of Work (PoW), which relies on computational power, DPoS relies on a voting system. TRX holders vote for SRs, who in turn validate transactions and produce blocks. This mechanism increases the network’s efficiency and scalability while reducing energy consumption.

- Super Representatives (SRs): There are 27 SRs on the TRON network, elected by TRX holders. These SRs validate transactions and maintain the blockchain. The DPoS system ensures that the network remains decentralized and secure, as SRs are rotated based on votes, preventing centralization of power.

Technical Details

- Smart Contracts: The JUST ecosystem relies heavily on TRON’s smart contract capabilities. These contracts are used to manage the issuance and collateralization of USDJ, the lending and borrowing operations on JustLend, and the trading mechanics on JustSwap.

- TRC-20 Tokens: JUST utilizes TRC-20 tokens, the standard for tokens on the TRON blockchain. JST, the native token of JUST, operates as a TRC-20 token and is used for governance, paying fees, and participating in the ecosystem’s various services.

- Oracles: JustLink acts as the oracle service for the JUST ecosystem, providing smart contracts with accurate and tamper-proof external data. This is crucial for maintaining the reliability and functionality of decentralized applications (dApps) within JUST.

By leveraging TRON’s high throughput and low transaction costs, JUST offers a scalable and efficient DeFi platform. Its comprehensive suite of products and the integration of advanced blockchain technologies set it apart from other DeFi projects, providing users with a robust and versatile financial ecosystem.

Tokenomics of JUST

Is JST a Token or a Coin?

JST is a token, specifically a TRC-20 token, which means it is built on the TRON blockchain. Unlike coins, which operate on their native blockchains (e.g., Bitcoin on the Bitcoin blockchain or TRX on the TRON blockchain), tokens like JST leverage the infrastructure of an existing blockchain for their operations and functionalities.

Emission Model

The emission model of JST involves a capped supply with specific allocations for various purposes. Here are the key details:

- Maximum Supply: 9.9 billion JST

- Circulating Supply: Approximately 2.26 billion JST

The distribution of JST tokens was initially conducted through a series of allocations and sales:

| Allocation | Percentage | Description |

|---|---|---|

| Seed Sale | 11% | Early-stage funding rounds |

| Public Sale (LaunchBase) | 4% | Sale to public participants on Poloniex LaunchBase |

| Strategic Partnerships | 26% | Allocations for strategic alliances and collaborations |

| Team | 19% | Reserved for the development team and future incentives |

| Airdrop (TRX Holders) | 10% | Distributed to TRX holders as part of initial marketing and adoption |

| Ecosystem | 30% | Funding for ecosystem development and growth initiatives |

Use Cases and Utility

JST serves multiple roles within the JUST ecosystem:

- Governance: JST holders can participate in the governance of the JUST ecosystem, voting on proposals and decisions that affect the platform’s development and operations.

- Fee Payment: JST is used to pay for various fees within the JUST ecosystem, including transaction fees, lending fees on JustLend, and stability fees for USDJ.

- Incentives: JST rewards are given to users who participate in liquidity provision, lending, and other activities within the ecosystem.

Price and Market Performance

JST is actively traded on numerous major exchanges, ensuring high liquidity and accessibility. The token has shown varied performance since its inception, influenced by broader market trends and developments within the JUST ecosystem. Here are some current and historical data points:

- Current Price: Approximately $0.033

- Market Cap: Around $310 million

- All-Time High: $0.2026

- All-Time Low: $0.0049

Market Dynamics

The value of JST is subject to market supply and demand dynamics. The price can fluctuate based on factors such as:

- Adoption and Usage: Increased usage of the JUST platform and its various services can drive demand for JST, potentially increasing its value.

- Market Sentiment: General sentiment towards the TRON blockchain and DeFi projects can also impact JST’s market performance.

- Technological Developments: Innovations and improvements within the JUST ecosystem or the broader TRON network can influence JST’s value proposition.

In summary, JST’s tokenomics reflect its multifaceted role within the JUST ecosystem, supported by a well-defined emission model and extensive utility. Its market performance is closely tied to the adoption of JUST’s DeFi services and the overall health of the crypto market.

Where to Buy JST Cryptocurrency

JST, the native token of the JUST ecosystem, is available on several major cryptocurrency exchanges. Here are some of the most prominent platforms where you can purchase JST:

- Binance: One of the largest and most popular cryptocurrency exchanges in the world. Binance offers high liquidity and a wide range of trading pairs for JST, including JST/USDT and JST/BTC.

- HTX (formerly Huobi): Another leading global exchange known for its robust security measures and user-friendly interface. HTX supports JST/USDT and JST/ETH trading pairs.

- MEXC: A growing exchange that provides a variety of trading options. MEXC lists JST with pairs such as JST/USDT and JST/BTC.

- Bybit: Primarily known for its derivatives trading, Bybit has also expanded into spot trading and lists JST among its supported tokens.

- KuCoin: Known for its extensive list of supported cryptocurrencies and user-centric services, KuCoin offers JST trading pairs including JST/USDT and JST/BTC.

To purchase JST, you can create an account on any of these exchanges, complete the necessary verification processes, and then deposit funds (such as USDT or BTC) to trade for JST.

Where to Store JST Tokens

Once you’ve acquired JST tokens, it’s essential to store them securely. Here are some recommended wallet options for storing JST:

- TronLink Wallet: A browser extension wallet specifically designed for the TRON network. TronLink supports all TRC-20 tokens, including JST, and offers features like transaction signing and interaction with TRON dApps.

- Trust Wallet: A mobile wallet that supports multiple blockchains, including TRON. Trust Wallet provides a secure and user-friendly interface for managing JST tokens, along with other cryptocurrencies.

- Ledger Nano S/X: Hardware wallets are considered one of the safest ways to store cryptocurrencies. Ledger devices support TRON and TRC-20 tokens through the Ledger Live app, ensuring offline storage and protection against hacking.

- Cobo Wallet: A multi-chain wallet that supports TRON and its tokens. Cobo Wallet offers both mobile and hardware options, providing flexibility for users who prefer different storage methods.

- Math Wallet: Another versatile wallet that supports multiple blockchains, including TRON. Math Wallet can be used as a browser extension, mobile app, or hardware wallet, offering comprehensive support for JST storage and management.

These wallets provide varying levels of security and convenience, allowing you to choose the option that best fits your needs. Ensure that you follow best practices for cryptocurrency storage, such as enabling two-factor authentication and keeping your private keys secure.

Project Prospects

The growth of the JUST project is underpinned by several key factors: its comprehensive suite of DeFi products, strategic partnerships, and a robust user base drawn from the broader TRON ecosystem. JUST aims to deliver a seamless and integrated DeFi experience, which positions it well in the competitive DeFi landscape.

Basis for Growth

- Diverse Product Offerings: JUST’s range of products, including JustStable, JustLend, JustSwap, and JustLink, cater to various financial needs such as stablecoin issuance, lending, token swaps, and decentralized oracles. This diversity helps attract a wide array of users and increases the platform’s utility.

- Integration with TRON: Built on the TRON blockchain, JUST benefits from TRON’s high throughput and low transaction costs. This integration not only enhances performance but also provides access to TRON’s extensive user base and ecosystem.

- Strategic Partnerships: JUST has established important partnerships within the blockchain space. For example, its collaboration with Poloniex for the initial token sale provided significant visibility and support. Other partners include major exchanges and DeFi projects that integrate with or support the JUST ecosystem.

Clients and Partners

Clients:

- DeFi Enthusiasts: Users looking for stablecoin solutions, lending platforms, and decentralized exchanges.

- TRON Community: Existing TRON users who leverage JUST’s products for various financial activities.

Partners:

- TRON Foundation: Provides technical and financial support.

- Poloniex: Facilitated the initial token sale and continues to support JST trading.

- Binance, HTX, MEXC, Bybit, KuCoin: Major exchanges that list JST and provide liquidity and trading support.

Forecast for Development

JUST is poised for significant growth, driven by ongoing product development, increased user adoption, and strategic expansions. The project aims to continually enhance its product offerings and integrate with more DeFi platforms and services.

- Product Enhancements: Continuous improvements and new features for existing products, such as JustStable and JustLend, will help maintain and grow the user base.

- Market Expansion: Expanding into new markets and increasing accessibility through more exchange listings and wallet integrations.

- Community Engagement: Growing the community through educational initiatives, incentive programs, and active participation in governance.

Project Ecosystem

The JUST ecosystem is a comprehensive suite of DeFi products designed to provide a full range of financial services on the TRON blockchain. Here’s an overview of its key components:

Ecosystem Components

- JustStable: A decentralized stablecoin issuance platform that allows users to mint USDJ by collateralizing TRX.

- JustLend: A decentralized money market protocol for lending and borrowing assets with interest rates determined by supply and demand.

- JustSwap: An automated market maker (AMM) for decentralized token swaps and liquidity provision.

- JustLink: A decentralized oracle system that connects smart contracts with real-world data.

Key Elements of the Ecosystem

| Component | Function |

|---|---|

| JustStable | Issues USDJ stablecoin |

| JustLend | Enables decentralized lending and borrowing |

| JustSwap | Facilitates decentralized token exchanges |

| JustLink | Provides secure and reliable data oracles |

By integrating these diverse services, the JUST ecosystem offers a holistic DeFi solution that meets the varied needs of its users. Its continued growth and development are likely to reinforce its position as a leading DeFi platform on the TRON blockchain.

Conclusion

In summary, JUST represents a significant advancement in the realm of decentralized finance, leveraging the TRON blockchain to provide a robust suite of financial products. The JST token plays a crucial role within this ecosystem, offering various utilities and governance capabilities. As the DeFi landscape continues to evolve, JUST’s comprehensive approach positions it as a notable player with promising growth potential.