In the dynamic and rapidly evolving landscape of blockchain technology, Flow stands out as a unique and highly promising project. This article provides an in-depth analysis of Flow and its native cryptocurrency, FLOW. We will delve into various aspects of the project, including its history, technological framework, tokenomics, ecosystem, growth potential, and future outlook. By examining these elements, we aim to offer a thorough understanding of Flow’s positioning and significance in the blockchain space.

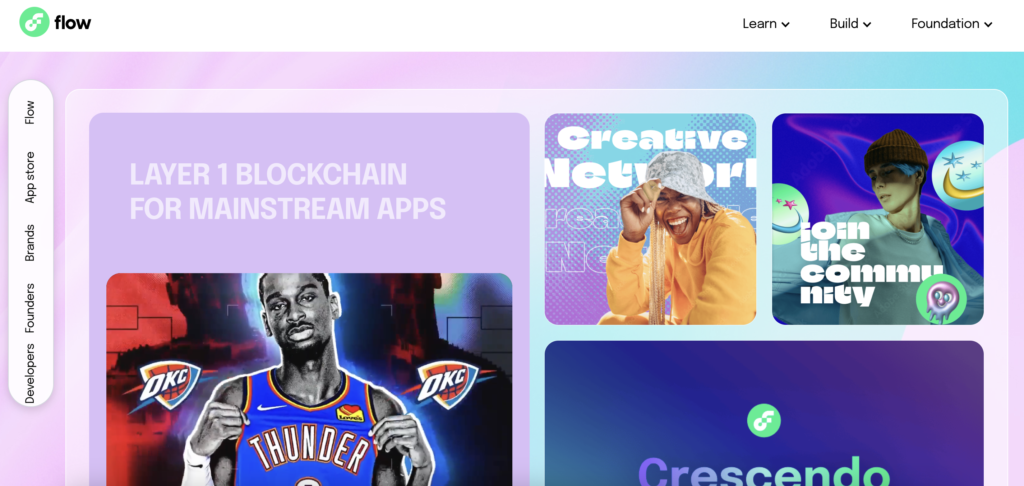

What is Flow?

Flow is a high-performance blockchain specifically designed for the next generation of digital applications, games, and digital assets. Unlike traditional blockchains, Flow offers a unique architecture that enhances scalability without compromising decentralization or security. The core innovation of Flow is its multi-role architecture, which divides the validation process into four distinct roles—Collector, Execution, Verifier, and Consensus Nodes—each optimizing different aspects of transaction processing. This allows Flow to handle massive amounts of transactions simultaneously, making it ideal for applications that require high throughput and low latency. The primary goal of Flow is to provide a developer-friendly platform that facilitates the creation of decentralized applications (dApps) and digital assets, thereby addressing the scalability and usability challenges faced by existing blockchain solutions.

History of the Project

Flow was founded to address the limitations of existing blockchain architectures, particularly in terms of scalability and usability for consumer applications. The project was officially announced in 2019, marking its entry into the blockchain ecosystem. Early development phases focused on designing the multi-role architecture and securing partnerships with leading game developers and entertainment companies.

One of the significant milestones in Flow’s history was the launch of its mainnet in 2020. This was a critical step in proving the viability of Flow’s architecture and attracting developers to build on the platform. Throughout 2020 and 2021, Flow gained significant traction with high-profile partnerships and the launch of successful projects on its network, including the widely recognized NBA Top Shot.

The project continued to evolve with regular updates and improvements to its core protocol, enhancing its performance and security features. By 2023, Flow had established itself as a leading blockchain platform for digital collectibles and dApps, demonstrating robust growth and a vibrant ecosystem of developers, users, and enterprises.

How Flow Works

Flow operates on a unique technological framework designed to optimize the performance of decentralized applications and digital assets. Central to Flow’s innovation is its multi-role architecture, which divides the validation process into four distinct roles—Collector, Execution, Verifier, and Consensus Nodes. This division allows Flow to scale efficiently while maintaining a high level of security and decentralization.

Multi-Role Architecture

- Collector Nodes: These nodes are responsible for improving the efficiency of the network by collecting and organizing transactions for subsequent stages.

- Execution Nodes: Execution Nodes handle the computational work associated with transactions. They execute the operations required by smart contracts and transactions, significantly enhancing the throughput of the network.

- Verifier Nodes: These nodes focus on double-checking the work done by Execution Nodes, ensuring that the computations are performed correctly.

- Consensus Nodes: Consensus Nodes are tasked with achieving agreement on the state of the network. They run the consensus algorithm to validate the transactions and ensure the network’s integrity.

Blockchain and Consensus Mechanism

Flow’s blockchain is designed to support high throughput and low latency transactions. It achieves this through its multi-role architecture, which allows parallel processing of transactions. This architecture is particularly suited for applications requiring high performance, such as gaming and large-scale dApps.

Flow uses a proof-of-stake (PoS) consensus mechanism to secure the network. In this system, validators are selected to produce and validate new blocks based on the amount of FLOW tokens they stake. The staking process involves locking up FLOW tokens as collateral, which helps secure the network and incentivizes honest behavior among validators.

Technical Details

- Cadence: Flow utilizes Cadence, a resource-oriented programming language designed for smart contracts. Cadence is built with a focus on safety and ease of use, incorporating features like asset safety, clear error messages, and a powerful type system that helps prevent common bugs and vulnerabilities.

- SPoCKs: Specialized Proofs of Confidential Knowledge (SPoCKs) are a unique feature in Flow that enables secure and verifiable execution of transactions. SPoCKs ensure that nodes can process transactions without revealing sensitive information, maintaining privacy and confidentiality.

- Upgradeable Smart Contracts: Flow supports upgradeable smart contracts, allowing developers to deploy and improve contracts over time without disrupting the network. This feature is crucial for iterative development and rapid innovation.

Flow’s approach to blockchain technology distinguishes it from other platforms by focusing on scalability and user-friendly development tools, making it a preferred choice for developers aiming to create complex and high-performance decentralized applications.

Tokenomics of Flow

Flow’s native cryptocurrency, FLOW, is a token that plays a crucial role in the network’s ecosystem. It is designed to facilitate various functions within the Flow blockchain, including transaction fees, staking, and governance.

Emission Model

FLOW has a well-defined emission model that aims to balance supply and demand while incentivizing network participants. The initial supply of FLOW was distributed through a combination of private sales, public sales, and allocations to the development team and ecosystem. A significant portion of the tokens is also reserved for community and ecosystem development, ensuring long-term growth and sustainability.

The distribution model is structured as follows:

- Private Sales: Early investors and strategic partners received a portion of the initial supply.

- Public Sales: FLOW was made available to the public through token sales, providing broader access to the token.

- Ecosystem Development: A substantial allocation is set aside to fund projects, partnerships, and initiatives that enhance the Flow ecosystem.

- Team and Advisors: Allocations to the founding team and advisors are vested over time to align incentives with the long-term success of the project.

Token Functions

FLOW tokens serve multiple purposes within the Flow blockchain:

- Transaction Fees: Users pay transaction fees in FLOW for executing transactions and smart contracts on the network. This mechanism helps prevent spam and ensures the network remains efficient.

- Staking: Validators are required to stake FLOW tokens to participate in the consensus process. Staking not only secures the network but also enables validators to earn rewards for their contributions.

- Governance: FLOW holders have the ability to participate in governance decisions, influencing the future direction and development of the Flow network. This includes voting on protocol upgrades, feature implementations, and other critical decisions.

Market Dynamics

The value of FLOW is influenced by various factors, including network activity, adoption of applications built on Flow, and broader market conditions. As of recent data, the price of FLOW has shown significant volatility, characteristic of most cryptocurrencies. The token’s value is closely tied to the success and growth of the Flow ecosystem, with increased usage and demand driving up the price.

Inflation and Deflation Mechanisms

Flow employs both inflationary and deflationary mechanisms to manage the supply of FLOW tokens:

- Inflation: New FLOW tokens are minted as rewards for validators participating in the staking process. This controlled inflation incentivizes network security and validator participation.

- Deflation: A portion of the transaction fees paid in FLOW is burned, permanently removing those tokens from circulation. This deflationary mechanism helps counterbalance inflation and can contribute to the token’s scarcity over time.

Flow’s tokenomics are designed to create a balanced and sustainable economic model, supporting the network’s growth while incentivizing active participation and long-term commitment from its stakeholders. The multifaceted role of FLOW within the ecosystem underscores its importance as both a utility and governance token, driving the overall health and success of the Flow blockchain.

Where to Buy FLOW Cryptocurrency

FLOW, the native token of the Flow blockchain, is available for trading on several major cryptocurrency exchanges. Here are some of the top platforms where you can purchase FLOW:

- Binance: One of the largest and most popular cryptocurrency exchanges in the world, Binance offers a wide range of trading pairs for FLOW, including against fiat currencies like USD and stablecoins like USDT.

- HTX (formerly Huobi): HTX provides comprehensive trading options for FLOW, including spot trading and various advanced order types, catering to both beginner and experienced traders.

- MEXC: Known for its user-friendly interface and extensive selection of cryptocurrencies, MEXC lists FLOW with multiple trading pairs and supports a range of order types.

- Bybit: Bybit is a leading platform for derivatives trading, but it also offers spot trading for FLOW, making it a versatile option for purchasing and trading the token.

- KuCoin: KuCoin supports a wide variety of cryptocurrencies, including FLOW, and provides users with advanced trading features, as well as earning opportunities through staking and lending.

Where to Store FLOW Tokens

Storing your FLOW tokens securely is crucial to protecting your investment. Here are some of the best wallets for storing FLOW:

- Dapper Wallet: The official wallet for the Flow blockchain, Dapper Wallet is designed to seamlessly integrate with Flow dApps, providing an intuitive and secure storage solution for FLOW tokens. It also supports direct purchases and transfers of FLOW.

- Ledger Nano S/X: Ledger hardware wallets offer robust security for storing FLOW tokens offline. These wallets provide top-notch protection against hacks and unauthorized access, making them a popular choice among serious investors.

- Blocto: Blocto is a versatile wallet that supports multiple blockchains, including Flow. It offers a user-friendly interface and integrated dApp browser, making it easy to manage and interact with your FLOW tokens.

- Math Wallet: Math Wallet supports a wide range of cryptocurrencies and blockchains, including Flow. It offers both mobile and desktop versions, as well as hardware wallet integration for enhanced security.

- Trust Wallet: A widely-used mobile wallet, Trust Wallet supports FLOW and provides an easy-to-use interface along with features such as staking and DeFi access, making it convenient for managing your tokens on the go.

Each of these wallets provides a secure and reliable way to store FLOW tokens, with options ranging from highly secure hardware wallets to user-friendly mobile applications. By choosing the right wallet, you can ensure the safety and accessibility of your FLOW holdings.

Project Growth Prospects

Flow’s growth prospects are rooted in its unique technological advancements, strategic partnerships, and expanding ecosystem. The project’s multi-role architecture and developer-friendly environment have positioned it as a preferred blockchain for building scalable and interactive decentralized applications (dApps), particularly in the gaming and digital collectibles sectors.

Clients and Partners

Flow’s client base and partnerships significantly contribute to its growth and adoption. High-profile clients and partners include:

- NBA Top Shot: A leading digital collectible platform that has gained massive popularity, showcasing the potential of Flow in the NFT space.

- Ubisoft: A major gaming company exploring blockchain integration through Flow, highlighting the platform’s suitability for mainstream gaming applications.

- Warner Music Group: Partnering with Flow to explore new ways of engaging with fans through blockchain technology.

- Dr. Seuss Enterprises: Collaborating to bring iconic characters to the blockchain as digital collectibles.

- Samsung: Integrating Flow into its blockchain ecosystem, expanding Flow’s reach to a broader audience.

These partnerships demonstrate Flow’s ability to attract and collaborate with industry leaders, enhancing its credibility and driving user adoption.

Growth Factors

Several factors underpin the growth potential of Flow:

- Scalability: Flow’s multi-role architecture allows it to handle large volumes of transactions efficiently, making it ideal for applications that require high throughput.

- Developer Support: Flow provides robust tools and resources for developers, including the Cadence programming language, which simplifies the creation and deployment of smart contracts.

- User Experience: Flow focuses on delivering a seamless user experience, which is crucial for mainstream adoption of blockchain applications.

- Ecosystem Expansion: Continuous development of the ecosystem, with new projects and applications being launched regularly, contributes to the network’s growth and vitality.

Development Forecast

Looking forward, Flow is poised for significant expansion as it continues to attract developers, users, and enterprises. The growing interest in NFTs and blockchain gaming will likely fuel Flow’s adoption. Additionally, ongoing improvements to the network’s infrastructure and functionality will support the development of increasingly complex and high-performance dApps.

Project Ecosystem

Flow’s ecosystem is a vibrant and expanding network of applications, developers, and services that leverage its blockchain. Key components of the Flow ecosystem include:

- Dapper Labs: The team behind Flow and several flagship projects like NBA Top Shot.

- Flowverse: A community-driven initiative providing resources and updates about the Flow ecosystem.

- OpenSea: One of the largest NFT marketplaces that supports Flow-based NFTs, increasing market liquidity and accessibility.

- Rarible: Another prominent NFT platform integrating Flow, expanding the reach of Flow-based digital assets.

The Flow ecosystem continues to grow, with numerous developers and projects joining the network, thereby enhancing its value proposition and ensuring long-term sustainability. The combination of strategic partnerships, robust technology, and a thriving ecosystem positions Flow as a leading blockchain platform with strong growth potential.

Conclusion

Flow represents a significant innovation within the blockchain ecosystem, characterized by its unique architecture and robust support for decentralized applications (dApps). This analysis has highlighted the multifaceted nature of Flow, from its technological underpinnings to its economic structure and ecosystem dynamics. As the blockchain sector continues to expand and mature, Flow’s distinct approach and solutions position it well for ongoing relevance and impact in the industry.