Compound is a pioneering project in the decentralized finance (DeFi) space that revolutionizes how users earn interest on their cryptocurrencies. By leveraging automated smart contracts on the Ethereum blockchain, Compound allows users to lend and borrow popular cryptocurrencies in a trustless manner. The project’s native token, COMP, plays a crucial role in facilitating governance and incentivizing user participation.

Project History

Compound was launched in 2018 by Robert Leshner and Geoffrey Hayes as part of their mission to create more open financial systems. Since then, it has become one of the flagship projects in the DeFi sector. Compound Labs, the organization behind Compound, has been instrumental in pushing the boundaries of decentralized lending and borrowing. Key milestones include the introduction of the COMP token in 2020, which marked a shift towards a more decentralized governance model where token holders can propose and vote on changes to the protocol.

What is Compound?

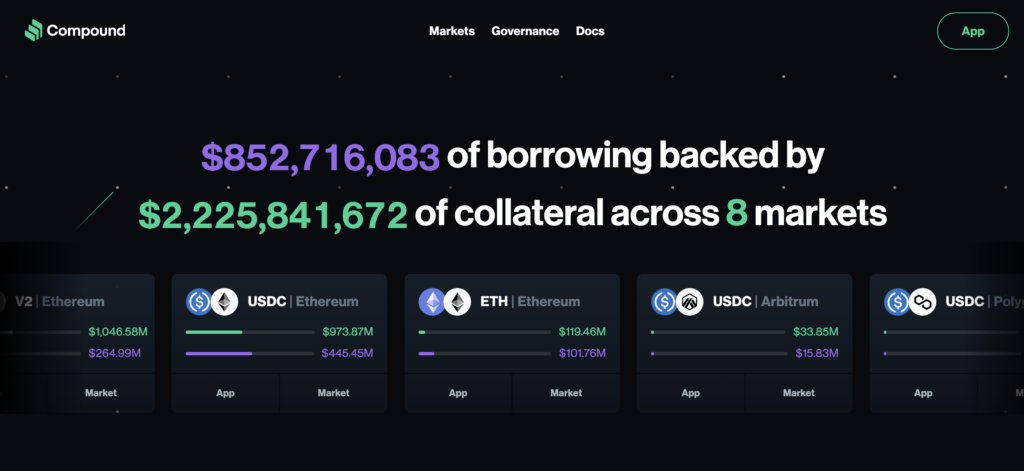

Compound is a decentralized finance protocol that enables users to lend and borrow cryptocurrency without a central intermediary. By depositing tokens into Compound’s liquidity pool, lenders can earn interest, while borrowers can take out loans by locking up collateral, all managed by smart contracts. This system is designed to automate interest adjustments based on supply and demand dynamics, ensuring a fair and transparent lending environment.

How Compound Works?

Compound is built on the Ethereum blockchain, which is key to its functionality and innovation within the decentralized finance (DeFi) landscape. The project utilizes a series of open-source smart contracts that automate all lending, borrowing, and governance processes. Here, we delve into the specific technologies that power Compound and distinguish it from other DeFi platforms.

Blockchain and Smart Contract Infrastructure

The backbone of Compound is the Ethereum blockchain. This choice leverages Ethereum’s widespread adoption and the robust ecosystem of tools and infrastructure that support Ethereum-based applications. Ethereum’s transition to a Proof of Stake (PoS) consensus mechanism under Ethereum 2.0 also benefits Compound by improving the scalability and efficiency of transactions on its platform.

Smart Contracts

Compound’s smart contracts are meticulously designed to handle the allocation of pooled assets, interest rate determination based on supply and demand, and the distribution of its governance token, COMP. These contracts are autonomous, executing predefined conditions without the need for intermediaries. For example, the protocol automatically adjusts the interest rates for borrowing and lending based on the changing dynamics of liquidity within the market.

Unique Algorithmic Innovations

A distinctive feature of Compound is its use of algorithmically adjusted interest rates. Unlike traditional finance or certain other DeFi projects that might have static or rarely changing interest rates, Compound’s rates are dynamic. They change frequently based on the ratio of supplied to borrowed assets in each liquidity pool. This is significant as it offers a flexible, market-driven approach to interest, increasing efficiency and ensuring stability in varying market conditions.

Consensus Mechanism

Compound itself does not employ its own consensus mechanism but instead relies on Ethereum’s mechanism. Initially, Ethereum used Proof of Work (PoW), which required extensive computational effort. With the network’s transition to Proof of Stake (PoS), Compound benefits indirectly through improved transaction throughput and reduced gas costs. This is particularly advantageous for DeFi applications, where speed and cost-efficiency are crucial.

Differentiation from Other Projects

What sets Compound apart from other DeFi platforms is its highly autonomous, algorithm-driven approach to interest and its governance model. The introduction of the COMP token allows for a practically user-driven governance framework where token holders vote on proposals to change the protocol. This model fosters a decentralized, user-led ecosystem where decisions are made collectively by those most invested in the protocol’s success.

Technological Details and Explanations

Each smart contract within Compound corresponds to an individual cToken market (like cETH for Ethereum or cUSDC for USD Coin). Users deposit assets into these markets and receive cTokens in return, which represent their stake plus accrued interest over time. These cTokens can be used as collateral to borrow other assets based on the collateral factor of each respective asset. The protocol’s security is reinforced by rigorous external audits and built-in safeguards against unexpected liquidity shortages or market manipulations.

Tokenomics of the Compound Project

COMP is a governance token, not a coin, within the Compound ecosystem. This classification is crucial as it highlights COMP’s primary function—to facilitate governance rather than act as a medium of exchange or store of value.

Role and Functionality of COMP

COMP tokens give holders the power to participate in the governance of the Compound protocol. This involves proposing changes to the protocol or voting on existing proposals. Each COMP token represents one vote, emphasizing the democratic approach to decision-making within the Compound ecosystem.

Emission Model and Distribution

COMP’s emission model is designed to decentralize the governance process progressively. The token distribution follows a set algorithm where COMP is distributed to all markets across the Compound protocol proportional to the interest being generated in each market. This means that users earn COMP passively by interacting with the protocol—either by lending or borrowing. There is a fixed supply cap of 10 million COMP tokens, ensuring that the token’s value is not diluted by endless creation.

Market Dynamics and Price Factors

The price of COMP is influenced by various factors, including overall participation in the Compound protocol, changes in DeFi popularity, and broader market sentiments in the cryptocurrency sector. As COMP tokens are used for governance, their value is intrinsically linked to the perceived effectiveness and future potential of the protocol they govern. This aspect makes COMP’s valuation highly sensitive to Compound’s operational success and the DeFi market’s dynamics.

Strategic Implications of COMP Distribution

The strategic distribution of COMP is aimed at aligning the interests of key stakeholders (lenders, borrowers, and developers) with the overall health and success of the platform. By earning COMP through protocol interaction, users are incentivized to act in the best interest of the Compound ecosystem. This model also encourages long-term engagement, as users benefit from both the financial aspects of lending and borrowing and the governance influence afforded by COMP holdings.

Where to Buy the COMP Token?

COMP tokens are widely available on several leading cryptocurrency exchanges, making them accessible to a broad audience of investors and users. Here is a list of prominent exchanges where COMP can be purchased:

- Binance: One of the largest and most well-known cryptocurrency exchanges in the world, offering high liquidity and multiple trading pairs for COMP.

- HTX (formerly Huobi): Known for its extensive selection of cryptocurrencies, HTX provides a robust platform for buying and trading COMP.

- MEXC: Offers a variety of crypto-to-crypto trading pairs and is recognized for its user-friendly interface and support for numerous cryptocurrencies, including COMP.

- Bybit: This exchange is favored for its advanced trading features and derivatives offerings, alongside spot trading options for COMP.

- KuCoin: Known for supporting a wide range of cryptocurrencies, KuCoin provides users with the opportunity to buy and trade COMP in several market pairs.

- Bitfinex: Offers sophisticated trading options and high liquidity, making it a suitable choice for trading COMP, especially for more experienced traders.

Each of these exchanges provides different interfaces, trading pair options, and fee structures, so users may choose based on their trading preferences and geographical location.

Where to Store the COMP Token?

When it comes to storing COMP tokens, users have several options that cater to different needs in terms of security, accessibility, and user control:

- Hardware Wallets: These are the most secure type of wallets as they store cryptocurrencies offline. Popular options for storing COMP include Ledger and Trezor. Both support Ethereum and ERC-20 tokens like COMP and are known for their robust security features.

- Software Wallets: For easier access and regular use, software wallets such as MetaMask or Trust Wallet are suitable choices. These wallets run as applications on your device, providing a balance of security and convenience. MetaMask, for example, integrates directly with the Compound platform, allowing users to manage their COMP directly within the DeFi ecosystem.

- Web Wallets: For users looking to interact directly with DeFi platforms without installing additional software, web wallets offer a browser-based solution. MyEtherWallet (MEW) supports COMP and provides a straightforward interface for managing tokens.

- Mobile Wallets: For users who prefer managing their assets on the go, mobile wallets like Trust Wallet or Coinbase Wallet provide easy access and management of COMP tokens directly from a smartphone.

Each storage option offers different features tailored to various usage patterns, from maximum security with hardware wallets to convenient access with software and mobile wallets. Users should consider their specific needs, such as security level, ease of access, and frequency of use, when selecting the appropriate storage solution for COMP tokens.

Project Prospects and Development Forecast

The growth potential of Compound is anchored in its innovative approach to decentralized finance, its strategic partnerships, and its active community of developers and users.

Growth Drivers

- Technological Innovation: Compound’s continuous development in its core protocol and integration of new features, such as the improvement of its interest rate models and governance processes, solidifies its position in the DeFi landscape.

- Regulatory Navigation: As global financial regulators begin to pay more attention to cryptocurrency and DeFi, Compound’s proactive stance on compliance could become a major growth driver, distinguishing it from less compliant competitors.

Clients and Partnerships

Compound’s ecosystem comprises a variety of stakeholders, including individual investors, institutional borrowers, and developers. Notable partnerships have been instrumental in enhancing the protocol’s adoption:

- Circle: Integration with USD Coin (USDC) has allowed Compound to offer a stable borrowing and lending experience, attracting a broader base of users.

- Coinbase: By listing COMP on one of the most accessible global exchanges, Compound has expanded its user base significantly.

- OpenZeppelin: Security audits and collaborations with leading blockchain security firms ensure that the Compound protocol remains secure and trustworthy.

Development Forecast

The future development of Compound is expected to focus on enhancing scalability and user experience, reducing transaction costs, and further decentralizing its governance structure. Additionally, as the Ethereum network transitions to more efficient consensus mechanisms, Compound is likely to benefit from reduced operational costs and enhanced transaction speeds.

The Compound Ecosystem

The ecosystem surrounding Compound is extensive, encompassing several elements that contribute to its functionality and user engagement:

- Developers: A broad community of open-source developers continually working to improve the protocol and develop third-party tools and integrations.

- Users: From retail to institutional clients, the diverse user base drives liquidity and stability within the Compound system.

- Decentralized Applications (DApps): Numerous DApps are built on or integrate with Compound, utilizing its open lending platform to offer everything from yield farming to more complex financial products.

- Governance Community: COMP token holders contribute to the protocol’s evolution through proposals and voting, directly impacting the strategic direction of the platform.

In summary, Compound’s growth is supported by technological advancements, strategic partnerships, and a robust community. Its prospects for future development are promising, given the evolving regulatory landscape and the ongoing innovations within the DeFi sector. The ecosystem of Compound not only supports its operations but also enriches its value proposition to all stakeholders involved.

Conclusion

Compound represents a significant advancement in how we perceive financial transactions and governance in the blockchain space. Its commitment to decentralization, combined with a robust technological framework, sets a high standard for future DeFi projects. For advanced users and investors, understanding the intricacies of Compound’s technology and strategic potential is essential for grasiving its long-term value in the evolving landscape of decentralized finance.