As the cryptocurrency market has expanded, it has introduced various new types of digital assets, among which non-fungible tokens, or NFTs, stand out as particularly intriguing. This article aims to clarify what NFTs are, their unique characteristics, applications, and to discuss both their advantages and disadvantages. Understanding these aspects will help in navigating the world of NFTs and assessing their potential and risks.

What are Non-Fungible Tokens (NFTs)?

NFTs are a type of digital asset that utilize blockchain technology to verify the uniqueness and ownership of a digital item. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible and can be exchanged on a one-to-one basis, each NFT is distinct and cannot be exchanged on a like-for-like basis with another token. This uniqueness makes NFTs ideal for representing ownership of one-of-a-kind items such as digital art, collectibles, musical works, or even virtual real estate.

The Evolution of NFTs

The initial experiments with NFTs began around 2012-2013 with the creation of Colored Coins on the Bitcoin blockchain. However, the significant development of NFTs started with the advent of Ethereum and the introduction of token standards such as ERC-721 and ERC-1155. These standards have enabled developers to create sophisticated and multifunctional tokens, including those representing unique digital assets. This evolution marks a pivotal expansion of blockchain’s capabilities beyond simple monetary transactions to include a variety of digital ownership forms.

How Do Non-Fungible Tokens (NFTs) Work?

Non-fungible tokens (NFTs) operate on a blockchain, a technology that uses a distributed ledger to ensure high levels of transparency and security. Most NFTs are created and managed using smart contracts on the Ethereum blockchain, although other platforms like Flow and Tezos also offer similar functionalities.

Token Standards (ERC-721 and ERC-1155)

NFTs are based on specific token standards such as ERC-721, which was the first to define a standard for the creation and management of unique tokens. The ERC-1155 standard goes further by allowing a single contract to manage multiple types of tokens, both fungible and non-fungible. This flexibility reduces transaction costs and simplifies transfers between users.

Metadata and Storage

Each NFT includes metadata, typically linking to the digital object it represents (e.g., an image, video, or audio file). Due to blockchain’s data size limitations, this metadata is often stored off-chain using a distributed file system such as IPFS (InterPlanetary File System). IPFS ensures long-term data preservation without the risk of loss due to centralized server failures.

Smart Contracts

Smart contracts automate the processes of creating, buying, selling, and verifying the authenticity of NFTs. Written in Solidity for Ethereum, these contracts execute on the blockchain, ensuring the fulfillment of specified conditions without the need for intermediaries. Smart contracts can incorporate features such as ownership verification, rights transfer, and issuing a limited number of copies of an item.

Identification and Authentication

Each NFT has a unique identifier that distinguishes it from all other tokens on the blockchain. This identifier, combined with the blockchain’s capabilities, enables the verification of the token’s authenticity and ownership history, which is crucial for determining its value and provenance.

These technological aspects make NFTs a powerful tool for the digital economy, allowing for the creation, exchange, and verification of the uniqueness of digital assets on a global scale without the need for trust in a centralized authority.

The Uniqueness of Non-Fungible Tokens (NFTs)

The uniqueness of non-fungible tokens (NFTs) lies in their non-fungibility, meaning that one NFT cannot be exchanged for another without a loss of value. This characteristic is crucial for items like art pieces, unique digital assets, and collectibles. Non-fungibility is facilitated by blockchain technology, which records each NFT with unique identifiers and metadata on a distributed ledger.

Verifying Origin and Authenticity

The origin and authenticity of each NFT can be easily verified thanks to the transparent and immutable nature of blockchain. Every transaction and the ownership history of a digital asset are permanently recorded on the blockchain. This eliminates the need for external auditors or certification bodies, allowing market participants to verify asset authenticity independently.

Smart Contracts and Digital Rights Management

NFT creators can implement smart contracts that establish rules for usage, transfer of rights, and royalty payments on each resale of the asset. These programs make the management of digital asset rights more automated and efficient, enhancing the creator’s control over how their work is used and compensated.

Interoperability Across Platforms

NFTs also support interoperability, enabling digital assets to be used across different platforms and applications that adhere to token standards. This capability expands the utility of NFTs and increases their potential audience by allowing them to be integrated into a variety of ecosystems.

These distinctive features make NFTs a powerful tool for representing ownership and managing digital rights, which is especially beneficial in the arts and collectibles sectors where uniqueness and provenance are of paramount importance.

Who Uses NFTs and How?

The use of NFTs spans a wide range of industries, from art and entertainment to technology, demonstrating the versatility of their applications. Here are some prominent examples of diverse NFT projects:

Art and Collectibles

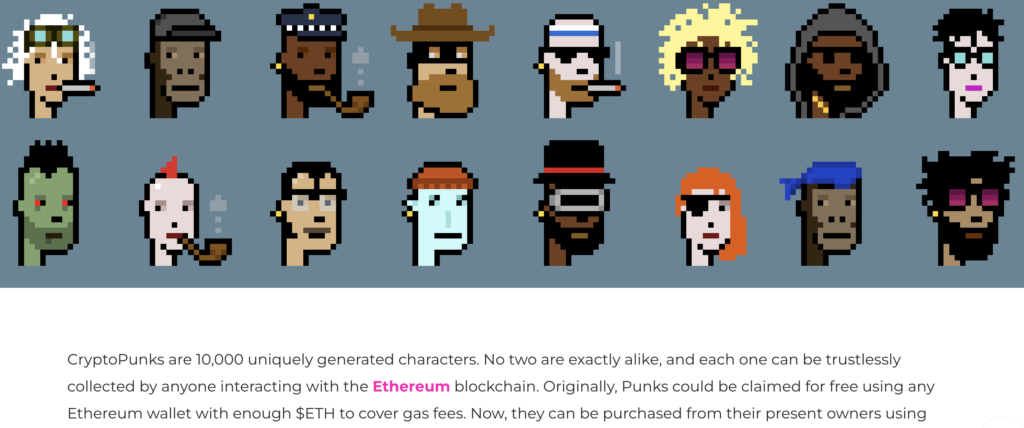

- CryptoPunks: One of the first and most famous NFT projects, CryptoPunks features a collection of 10,000 uniquely generated pixel images. Each CryptoPunk has distinct characteristics and accessories, making some exceptionally rare and valuable.

- Beeple: Artist Mike Winkelmann, known as Beeple, sold an NFT of his work “Everydays: The First 5000 Days” for $69 million at a Christie’s auction. This compilation of 5,000 digital images, created daily over nearly 14 years, has become a symbol of the potential of NFTs in the art world.

Virtual Real Estate

- Decentraland: A virtual world where users can buy and sell land parcels as NFTs. Landowners can build various structures and organize events, creating unique virtual spaces that can be monetized through different activities.

Sports and Entertainment

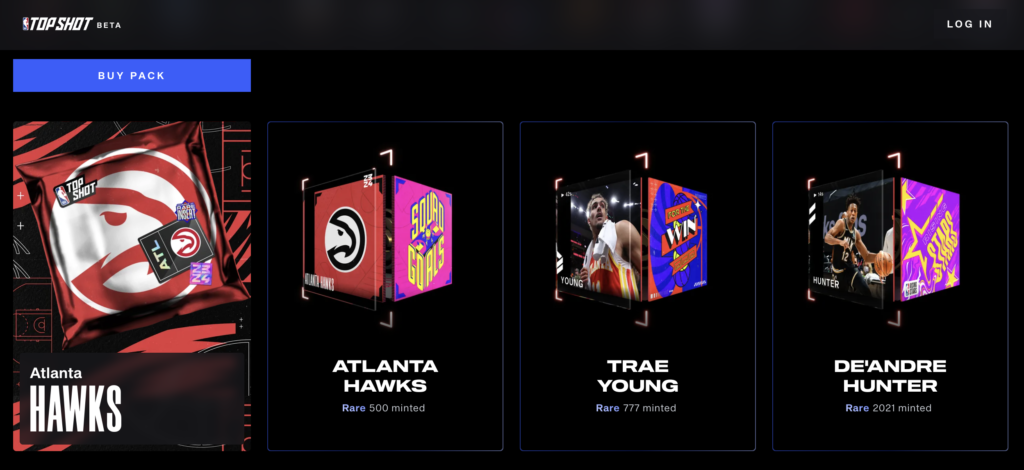

- NBA Top Shot: This project offers collectible NFTs featuring video highlights from National Basketball Association games. Fans can buy, sell, and trade these digital collectibles, which capture iconic moments from NBA seasons.

Music

- Kings of Leon: The rock band released their album as an NFT, providing purchasers with exclusive bonuses such as limited access to concert tickets and special audiovisual effects available only to NFT owners.

These projects illustrate how NFTs can transform traditional approaches to digital assets by adding elements of uniqueness, rarity, and new opportunities for interaction and monetization.

List of NFT Marketplaces

NFT marketplaces are specialized platforms for buying, selling, and trading non-fungible tokens. These platforms not only facilitate transactions between users but also provide tools for creating NFTs, assisting artists and content creators in monetizing their work within a new economic landscape.

OpenSea

OpenSea is one of the largest and most popular platforms for purchasing, selling, and exchanging NFTs. It is a versatile exchange that supports a wide variety of NFT types including art, virtual real estate, collectibles, and more. The platform offers tools for creating your own NFTs and supports multiple blockchains such as Ethereum, Polygon, and Klaytn, making it accessible to a broad audience.

Rarible

Rarible is a decentralized NFT exchange that allows users to both create and trade NFTs directly, without intermediaries. The platform encourages community participation through governance, giving token holders of RARI the right to vote on platform development issues. Rarible supports multiple blockchains including Ethereum and Flow, focusing on creating a transparent ecosystem for creators and collectors.

SuperRare

SuperRare specializes in rare and high-quality digital art. The platform meticulously curates artists and artworks, ensuring a high level of exclusivity and quality of the works offered. Transactions on SuperRare are conducted using Ethereum, and the platform emphasizes direct interaction between artists and collectors.

Foundation

Foundation is a platform for the creative community and art market where artists can auction their works as NFTs. The platform emphasizes experimentation with digital art and provides tools for creating limited editions. Foundation uses Ethereum and offers a unique model where only invited artists have access to create NFTs.

Each of these NFT exchanges offers unique features and targets different segments of the market, providing users with multiple options for engaging with the digital asset ecosystem.

Pros and Cons of NFTs

Like any technology, NFTs have their advantages and disadvantages. Here we explore these aspects to provide a balanced view of their impact and potential.

Pros of Non-Fungible Tokens

- Monetization for Creators: NFTs offer artists, musicians, and other creative professionals new ways to monetize their work. They can sell their creations directly to the audience, bypassing intermediaries, which increases their revenue and control over their work.

- Transaction Transparency: Blockchain technology ensures transparency and traceability of all transactions, reducing the risk of fraud and facilitating the verification of authenticity and provenance of assets.

- New Collecting Opportunities: NFTs open the door to digital collecting, offering rare and unique assets that can cater to the interests of collectors and investors alike.

- Durability of Digital Assets: Thanks to blockchain, information about NFTs and associated digital assets is securely stored and protected from loss or data corruption.

- Expansion of Markets: NFTs create new markets and opportunities across various sectors, including art, music, entertainment, and more, allowing developers and entrepreneurs to experiment with new business models.

Cons of Non-Fungible Tokens

- Environmental Concerns: The mining and processing of transactions on blockchains, especially those like Ethereum, require significant amounts of energy, raising concerns about environmental impact.

- Market Volatility: The NFT market is highly volatile, and the value of tokens can change dramatically due to shifts in demand and market sentiment.

- Intellectual Property Issues: While ownership of NFTs is clear, intellectual property issues often remain unresolved, particularly regarding the rights to use the digital content associated with NFTs.

- Security Risks: As with any blockchain-based technology, NFTs are susceptible to security risks such as hacking attacks on wallets and platforms where tokens are stored and traded.

- Accessibility and Inclusivity: Although NFTs can offer new monetization opportunities, they can also exacerbate inequality, as access to buying and selling NFTs may be limited for people without the necessary technological knowledge or financial resources.

These pros and cons illustrate that while NFTs offer significant opportunities for innovation and creativity, they also pose certain challenges and risks that need to be considered when engaging in this rapidly evolving market.

Future Prospects of NFTs

The future prospects of non-fungible tokens (NFTs) remain broad and diverse as this technology continues to impact multiple sectors from art to gaming and real estate. The growing interest in using NFTs for digital rights management opens new avenues for content creators, providing artists, musicians, and writers with the means to securely and transparently register rights to their works, automate payments, and manage licenses.

Digital Identity and Privacy

Beyond these applications, NFTs can play a crucial role in revolutionizing digital identity. Individuals can use NFTs to create unique digital identifiers that can be used for personal identification in online spaces. This can enhance security and privacy for user data, giving individuals control over their personal information directly.

Real Estate and Property Management

In the realm of real estate, there is exploration into using NFTs to represent ownership of land and buildings, which could radically change the processes of buying, selling, and transferring rights. With NFTs, transactions could be conducted faster, more easily, and with lower costs compared to traditional methods.

Gaming Industry

In the gaming industry, NFTs offer opportunities to create entirely new in-game economies where players can own, buy, and sell game items as real assets, providing a new level of engagement and monetization.

Addressing Technical and Environmental Challenges

However, to fully realize the potential of NFTs, some technical and environmental challenges need to be addressed, including reducing the energy consumption of blockchain networks and improving the scalability and accessibility of the technologies. Innovations in more efficient and environmentally friendly blockchain solutions, such as Ethereum’s transition to a proof-of-stake consensus mechanism, will help overcome these barriers.

Conclusion

Overall, the future of NFTs looks promising, offering revolutionary possibilities for a range of industries. This will contribute to the further expansion and integration of the technology into various aspects of the digital and physical economies.

NFTs represent a powerful tool for transforming the digital economy, offering new opportunities for creators and collectors. They introduce an element of uniqueness into the digital world, making each token valuable not only materially but also from a cultural perspective. While the challenges associated with NFTs require attention, their potential and capabilities remain significant.